Earnio results for September 2024

1 year ago

Tomáš Hucík

In the fall of 2024, the cryptocurrency market stands at the crossroads of major macroeconomic events that have the potential to change the shape of the crypto environment for traders and investors for a long time to come.

From interest rate cuts by the Federal Reserve , to renewed interest in bitcoin ETFs and the US election, to the macroeconomic view of companies like BlackRock on bitcoin itself. So in today's article, we'll take a look at some of these events together.

Fed rate cuts

Probably the most important event, which I've mentioned several times, was the Federal Reserve's decision to cut interest rates in September 2024. Faced with the pressure of slowing economic growth and growing fears of a mild recession, the Fed cut rates by 50 basis points. The move was seen as an effort to stimulate borrowing and spending, but it also had a significant impact on the cryptocurrency market.

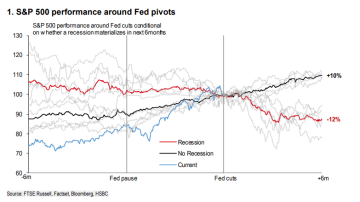

Lower interest rates traditionally reduce the attractiveness of fixed income assets such as bonds, leading investors to seek alternative yields. Cryptocurrencies, particularly bitcoin, have benefited from this risk environment as investors have sought assets that could appreciate in a declining rate environment. This is consistent with the narrative that bitcoin, often dubbed "digital gold," acts as a hedge against inflation and fiat currency devaluation. It has to be said, however, that the sudden rise is probably just speculation for now, as the real asset growth will only start to show over the next few months as interest rates are cut.

Source: Bybit, Earnio. Example of asset price growth on the SP500 index. But SP500 prices only rise if the economy is not hit by a recession

Bitcoin ETFs

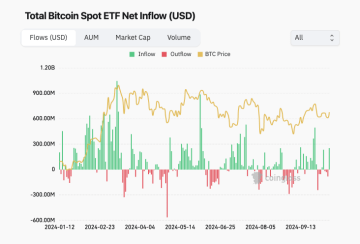

September also saw renewed interest in bitcoin ETFs, which had been somewhat muted over the summer. The recent Fed rate cuts and stabilization of inflation expectations have sparked a surge in institutional inflows into these instruments. Volumes in bitcoin ETFs jumped by more than 25% compared to August, signaling growing institutional confidence in the asset class.

Source: https://www.coinglass.com/bitcoin-etf

Several funds, such as BlackRock's IBIT and Fidelity's FBTC, saw increased trading volumes, a potential explanation being that institutional investors were seeking exposure to bitcoin, precisely because of the aforementioned rate-cut effect.

Key levels are holding firm

During the month, bitcoin prices fluctuated significantly, with the closing price of the daily candle at the end of September 30, 2024 hovering around $63,329.50. Midway through the month, the price of bitcoin briefly touched as high as US$66,000, due in part to the market's reaction to US inflation data and the Federal Reserve's interest rate cut. Then, in early October, there was another brief drop, mainly related to tensions in the Middle East.

Currently, the bitcoin price is hovering in a range between resistance (the price threshold the market has trouble crossing) around $65,000-66,000 and support (the price threshold below which the market typically does not fall) around $58,000, with lower support then around $54,000.

The RSI, an indicator that signals how overbought the market is (at the very bottom of the chart), shows readings around 70, which is relatively higher. When this indicator rises clearly above 70, it means the market is overbought, and a correction could potentially follow. Source: tradingview.com

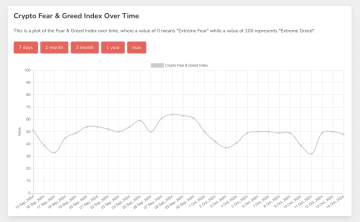

Fear and greed, showing how greedy vs. how fearful market participants are, is also at its mid-range. This too nicely illustrates the fact that the markets are in some sort of "equilibrium" state. But perhaps a better term would be in "limbo". This term would nicely describe a situation where the markets are waiting for the next major event, which is likely to be the US presidential election.

Source: https://alternative.me/crypto/fear-and-greed-index/

US presidential election

Trying to predict the outcome of the US presidential election when the probability of either candidate winning is essentially equal to the outcome of a coin toss seems like a difficult task indeed. Donald Trump is positioning himself as a crypto-candidate and so his election could, at least in the short term, lift markets significantly. Kamala Harris may not be anti-cryptocurrency, but her stance is much more uncertain. Thus, this close race may decide where the cryptocurrency industry will go for at least a few months.

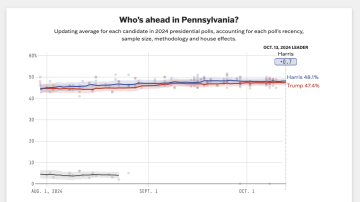

The most "mainstream" and classic polls currently favor Kamala Harris.

According to data from a BBC article Kamala Harris currently leads 49:46. It's just that the US electoral system is specific in that the candidate with the most votes may not win. It's actually through the electoral college. Each of the 50 states is allocated a certain number of electors based on population. So you don't need to get a majority of the population on your side, but a majority of the electoral votes. So the few states where support for the two candidates is most evenly matched will decide who becomes US President. At the moment, it looks like Pennsylvania will be the most key state. The latter, with 19 electoral votes, is relatively big largein size, so it is likely that whoever gets Pennsylvania will win the election.

According to the poll, Pennsylvania is currently led by Kamala Harris, but only by 0.7%, which may well be a statistical outlier. But it is true that she has been leading in the polls there, albeit very narrowly, for quite some time

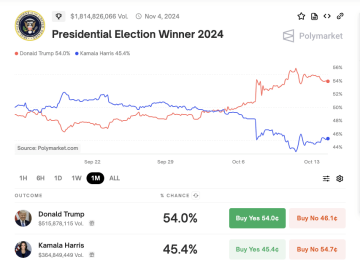

So, according to the national polls, even the polls in the most key state, Kamala Harris is ahead. But then why is Donald Trump leading, according to the world's largest prediction market, polymarket.com.

There may be several reasons for the disparity. Polymarket is essentially a crypto-native tool and so naturally gravitates more towards Trump. On the other hand, Kamala Harris also led there for a long time, so he's probably not that biased.

Plus, you can "trade" predictions on Polymarket. So the fact that a candidate is leading doesn't mean that people are betting on him winning, but rather that they are betting that he will be closer to winning in the future than he is now, at least for a while, and that they will realize a gain at that point.

But one of the reasons for this may be that market participants are paying more attention to granular data. One can go down to the state level in the analysis and even down to the district level. Similarly, complicated data from different indicators can be applied across many states. But even this data can be very difficult to interpret and with a small sample size the result can be biased which makes drawing conclusions and making informed estimates difficult.

Example of granular data analysis

In the key state of Pennsylvania, voters can vote by mail, but in order to do so they must first request this service. Currently, Democratic supporters, presumably Kamala Harris voters in Pennsylvania, are requesting this service more. If current trends continue, it is estimated that there will be roughly 480,000 more applications for voting by mail in Pennsylvania by Democrats, than by Donald Trump’s Republicans.

A clear advantage for Democrats, right? This is where it gets interesting.

When Joe Biden won in 2020, he had about a 1.2 million edge in mail-in requests in Pennsylvania. The thing is, it was during Covid era. Now it looks like the Democratic lead will be rougly about 480,000. Which is still a nice lead, but there's a small catch.

Joe Biden only won Pennsylvania by 80,000 votes.

Now let's make this even more complicated.

The ratio of vote by mail requests in 2000 was about 2.51 in favor of the Democrats. (2.5 Democrat requests vs 1 Republican request) Now it looks like the ratio of vote by mail requests will only be about something like 1.7 - 1.8 in favor of the Democrats. (1.7 Democrat request vs 1 Republican request).

So by that metric, the lead for the Democrats is starting to shrink.

The calculation doesn't take into account the fact that just because you support a party doesn't necessarily mean you'll end up voting for their candidate.

So Pennsylvania will probably be very close indeed, perhaps even more so than in previous years.

Whatever the outcome of the US election, we can expect a volatile environment until then, with cryptocurrency prices likely to be in a “limbo” status, moving only within a clearly defined price range.

How has our Earnio dealt with this volatile environment?

At Earnio, we continue to follow the strategy I presented in my previous article.

We have a cautious bullish view on the markets in the short term with clearly defined rules on how to behave in case the market goes up or in case it goes down.

Algorithmic strategies are those that automatically, without human intervention, trade a basket of capitalized cryptocurrencies,. These strategies entered positions at the beginning of the month and gradually started closing out gains over time. But because there were also some open positions from August that were not doing so well, those September gains were not as high.

A trade on BTCUSD where the strategy nicely captured the price action around the rate cut announcement.

But in Earnio we also used bionic spot trading, in this case it was mainly ethereum and bitcoin. The familiar "buy the bottom, sell the top" worked nicely and we exited the position around the local top when it was clear the market had no strength to continue and the downside came in early October.

If you're thinking this trade looks suspiciously similar to the one in the StayKing article, it's because we started using the same bionic strategies (manual trading) for Earnio and StayKing, but they differ in position size and risk management. Applying the same strategy saves time for the trader and allows him to spend more time developing new strategies.

The non-directional part of the portfolio, i.e. liquidity providing on centralised and decentralised exchanges and arbitrage, was only a small addition in September and had no impact on the final result.

In such an uncertain period, we managed a very nice result and so for the month of September 2024 Earnio closes a profit of 2.02%, i.e. 218,266 USDC.