Earnio results for July 2025

6 months ago

Tomáš Hucík

In July 2025, Bitcoin broke the $120,000 mark for the first time in history. Its price saw a monthly increase of 8%, while the Bitwise 10 Crypto Index fund, representing the 10 largest cryptocurrencies by weighted averages, rose by 12%, and the total market capitalization of all cryptocurrencies saw an increase of 14%. After a long period, altcoins and other cryptocurrencies outperformed Bitcoin.

In such a market, we proceed exactly as I mentioned in my previous articles:

"... The portfolio is still somewhat more oriented towards long positions."

In my previous article, I also described our strategies like this:

“…the strategies are spread across more than 20 cryptocurrencies, aiming to capture a possible broader growth in altcoins, which would yield higher returns.”

So if you read my articles regularly and follow the market trends, the July result is no surprise to you.

Throughout July 2025, our automated algorithmic trading strategies executed 367 trades, and our result for the month was +23%.

Comparison with Benchmarks and Other Assets

Earnio's performance thus roughly doubled the performance of the benchmark, the index of the 10 largest cryptocurrencies. The main reason for this was our consistent adherence to our strategy and sticking to the portfolio direction we had planned.

In the previous article, I also explained the essence of trading. Focusing on achieving the highest success rate can be a misleading metric. Just like last month, this month our success rate was again below 50%, but the result of our trading was record high.

It is not about achieving the highest success rate of trades, but about ensuring that the total sum of profitable trades outweighs the losing ones.

Since the average profit per trade this month was $3,688, while the average loss was only $1,465, despite the lower success rate, we finished the month with a very nice profit.

All of our trades are equipped with a Stop-Loss order. If a trade moves in the wrong direction, it is closed once it reaches a predefined price. This limits the loss, as we set where the potentially losing trade will close. Negative results are thus always controlled and managed.

This principle of loss management is even more clearly seen in the best and worst trades. Our best trade was $45,000, and the worst only - $5,800.

Our best trade was closed by the CGR strategy, on the XLMUSDT pair. Stellar Lumens (XLM) is a "dinocoin," meaning it has been on the market for a longer time and has been through several cryptocurrency cycles. These cryptocurrencies may lag behind Bitcoin, but when their time comes, they can do 100% in just a few days. The CGR strategy, which traded it, calculates the price deviation from its center and can identify areas where price reversals are likely to occur with minimal delay. It nicely captured this movement.

Our worst trade was closed by the GGS strategy on the AVAXUSDT pair. The strategy opened a short position, betting that the price would go down. The GGS strategy trades price movements in the direction of the trend, using various timeframes. The drop over a few days was evaluated as a developing trend, and the strategy traded on its continuation. However, the price of Avalanche (AVAX) started rising, and the trade was closed.

The CGR strategy was our most effective strategy in July, with its setup, which can capture market direction changes, proving key as it effectively captured price movements in altcoins.

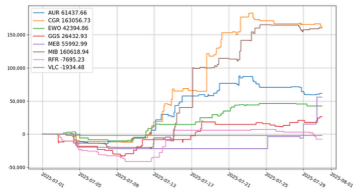

Performance Overview of Strategies for July 2025

For August, we will keep the strategies oriented toward a growing market. The market structure currently suggests more of a potential consolidation than a correction, so there is a high probability that the market could move further upwards.

Crypto Market Overview – July

July 2025 brought another significant milestone for the cryptocurrency market. Bitcoin broke the $120,000 mark for the first time in history. The combination of institutional demand, inflows into Bitcoin ETFs, and the creation of companies specializing in Bitcoin investment pushed the price upwards. Additionally, the US Congress discussed a set of pro-crypto laws during "crypto week," and President Trump openly supported the industry.

Ethereum, the second-largest cryptocurrency, showed an even steeper growth, which may signal a return of interest in altcoins. The total market capitalization of cryptocurrencies reached a new record of around $3.8 trillion, reflecting renewed optimism across the market.

Major market movements in July

Bitcoin entered July around the $105–107K level, close to the June closing price. However, in the first two weeks, it gained significant momentum. On July 14, Bitcoin surged to a new all-time high of around $123,150, breaking the psychological $120,000 level. Shortly after, it corrected slightly back below that level, but still closed the month around $115–116K, up around 8% from the beginning (Coindesk). The key support level moved to around $112–110K (the previous May high), and it successfully tested that upper boundary as new support in July. If Bitcoin holds this level, it could serve as a good foundation for another growth wave. On the other hand, the ~$120,000 level is proving to be a significant resistance. A major breakout above $125K (which Bitcoin has unsuccessfully tried) could open the door for further growth, while a drop would find strong support at the psychological $100,000 level.

Source: tradingview.com

Ethereum (ETH) outperformed Bitcoin in terms of profitability in July. In the second half of the month, Ether surged to $3,900. However, Ethereum still remains below its all-time high (~$4,870 from November 2021). The breakout of the local resistance at $3,800 paved the way for further growth, but the $4,000 level is a strong barrier, where profit-taking can be expected in the short term.

Altcoins held back initially in July but gained momentum as Bitcoin stabilized at new levels, leading to increased appetite for riskier assets. XRP (Ripple) finished the month at around $3.30, while Dogecoin (DOGE) saw an 8% daily rally towards the $0.25 mark. Some smaller projects showed double-digit percentage gains in a single day, illustrating the return of speculative capital.

However, it's clear that the growth in altcoins wasn't widespread—investors were selective. High-quality large-cap altcoins with clear fundamentals benefited from the positive sentiment, while others ended the month in the red (e.g., Sonic (S), Virtuals Protocol (VIRTUAL), OKB token (OKB)).

This example clearly shows that identifying fundamentally strong projects and successfully trading them remains the key combination for any trader. If a trader is unable to do so, it is better to leave trading to the professionals.

Key macroeconomic developments

The United States grabbed the most attention. The House of Representatives advanced a set of pro-crypto laws during "crypto week" (including the Genius Act for stablecoins) as part of an effort to create a clear regulatory framework. This provided investors with confidence that cryptocurrencies would receive a more favorable and unified regulatory oversight. President Donald Trump also positioned himself as a “crypto-friendly” leader, publicly calling himself the “crypto president,” and in July, his administration struck a significant trade deal with the EU, reducing the proposed high tariffs on imports from 30% to 15%. This easing of trade tensions immediately improved global sentiment and provided a new boost to risk assets, including crypto.

ETF and Institutional Capital Inflows

Institutional investors continue to play a key role in the crypto market, and July only confirmed this. Cryptocurrency ETFs saw record inflows of capital—US funds alone attracted approximately $12.8 billion in July, the highest ever in a single month. The largest fund, BlackRock iShares Bitcoin Trust (IBIT), surpassed $86 billion in assets under management.

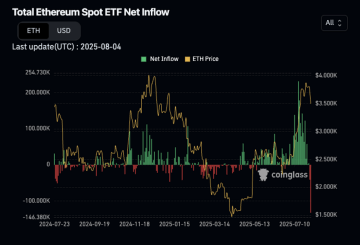

It is worth noting that the success of ETFs wasn't limited to Bitcoin but also Ethereum. Ethereum spot ETFs in the US saw their best month in history, with inflows exceeding $5.4 billion. In the 12-month history of these products, it was the strongest period yet—compared to the second-best month, December 2024, with "only" $2.1 billion. Institutions thus significantly increased their exposure to ETH in July. By the end of the month, US funds held around $21.5 billion in Ethereum, which corresponds to ~4.8% of Ethereum's total market capitalization.

The continuous capital inflow into crypto funds shows that institutional interest in crypto is reaching new highs. The US SEC even allowed “in-kind” creations and redemptions for ETFs (i.e., exchanging underlying cryptocurrencies for fund shares and vice versa without the need for cash settlement). This technical change may further increase the efficiency and attractiveness of cryptocurrency ETFs for institutional use, as it allows fund managers to work more flexibly with underlying assets.

Massive institutional inflows have very specific effects on the market. By absorbing large volumes of BTC and ETH, ETFs act as a figurative safety net for the prices of these assets, even during large sell-offs. When greater volatility occurred in the middle of the month, ETFs bought the dip, which helped soften the depth of the correction. Their presence increased market liquidity and partially dampened volatility, contributing to market stabilization and maintaining a bullish sentiment.

Fear and Greed Index and Market Sentiment

Investor sentiment shifted from cautious optimism to euphoria and back to moderate happiness by the end of the month. The Fear & Greed Index stayed in the "greed" zone for most of the month, signaling a prevailing bullish sentiment. By early July, the index was around 60 (indicating greed), and with Bitcoin's rocket-like growth, it kept rising. In the middle of the month, it reached around 79, deep in the "extreme greed" zone. Such high levels of sentiment, where fear is almost absent, were last seen at the end of May.

It is no surprise that social media was flooded with excitement, meme images, and “FOMO” moods, and even Google saw a sharp increase in searches for the word “Bitcoin” during this period. However, it is important to note that the interest also dropped relatively quickly.

Outlook for August 2025

Entering August 2025, the crypto market is in a significantly stronger position, but it is aware that after such a strong rise, a phase of consolidation or correction is not excluded. On a macro level, conditions remain favorable: global liquidity should continue to increase (central banks are signaling caution and possible rate cuts), and investors are likely to continue “searching for yield” outside traditional markets. If there is no new inflation shock, the environment of lower rates and declining inflation will continue to play in favor of risk assets, including cryptocurrencies.

Bitcoin, after its record-breaking July, may consolidate its gains in August. In the short term, we expect movement within a range—perhaps between $112,000 and $125,000, where a new balance between buyers and sellers is likely to form. The $112,000 level (previous high) should serve as strong support. If the market fails to maintain this level for an extended period, a deeper correction towards $100,000 could occur, which is another psychological barrier strengthened by the long-term average. On the upside, the key factor will be whether Bitcoin can break above ~$125,000—such a move would likely trigger another buying wave (a breakout rally) and could push the price higher (another significant target could be in the $130,000–$140,000 range).

Altcoins in August may face an interesting period. If Bitcoin remains stable or grows slowly, the “altseason” scenario could repeat, where capital flows into a wider range of cryptocurrencies. Ethereum would likely benefit the most from such a rotation, often being the main beneficiary of altseason due to its role as a platform for DeFi and its strong network effect. Moreover, once the initial excitement around Bitcoin fades, institutions may look for more opportunities in ETH, as indicated by the record buys in July. Highly speculative altcoins and memecoins may have mixed fortunes in August: some may become attractive “dip-buy” targets for brave traders after a correction, while others may continue to lose ground if sentiment cools. Therefore, selecting quality projects will remain crucial.