Earnio results for May 2025

8 months ago

Tomáš Hucík

In May 2025, Earnio Dynamic achieved a performance of +12.99%, marking another solid month for our algorithmic trading strategies. This result confirms Earnio’s consistent ability to generate returns even in the high-volatility environment typical of the cryptocurrency market. With Earnio, the ever-present crypto market risk is under control.

Comparison with Benchmarks and Other Assets

As a benchmark for Earnio Dynamic, we use an index of ten major cryptocurrencies, each with a 10% weighting (Benchmark Top 10, matching an index available on Binance). We find this benchmark appropriate because our strategies expose clients to a broader market spectrum—not just a single asset like bitcoin.

Moreover, bitcoin does not generate any cash flow, whereas Earnio Dynamic pays out rewards monthly, enhancing its appeal and enabling investors to work actively with their yield (even if occasionally a bit unpredictable).

In May 2025, the Benchmark Top 10 saw modest growth of around +7.5%. Thus, Earnio Dynamic outperformed this benchmark by more than four percentage points, demonstrating the effectiveness of our trading strategies in capturing market growth opportunities.

Compared to bitcoin, which also saw a performance of around +12% in May, Earnio delivered a similar result. However, thanks to its diversified approach in both strategy and traded assets, it provided more robust risk control.

It must be acknowledged that April’s bitcoin price surge, which we managed to catch early, gradually faded. We are already working with the team to improve the algorithms for better capture of such price movements. Compared to the Benchmark Top 10, the performance over the last two months has been roughly the same.

Stability in an Unstable Environment

Earnio’s strength lies in its ability to maintain stability even during significant market fluctuations. Highly volatile assets like cryptocurrencies can drop by -30% to -90% in bear markets, which can be mentally overwhelming or even unbearable for many investors. Thanks to its algorithmic approach, Earnio Dynamic significantly mitigates these declines.

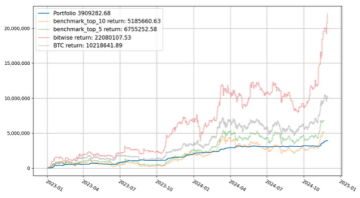

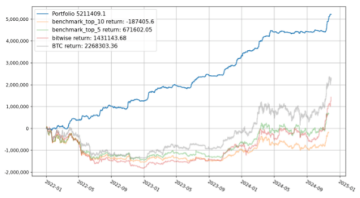

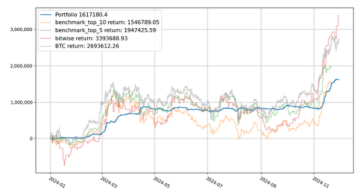

To provide a comparison, we offer backtest data using the same risk profile currently used in our algorithmic strategies. Performance comparisons with "passive" instruments or commodities greatly depend on the start date of measurement—so we provide several timeframes for better perspective.

The actual performance of Earnio during its first two years didn’t directly match benchmark comparisons because we intentionally reduced trade sizes—and thus potential returns. This cautious approach was primarily aimed at managing risk.

As you know, launching a fund gives you only one chance to build trust, so we chose to build our track record carefully. Since early 2025, however, the risk profile has been aligned with the one used in the benchmark comparison backtests.

Trading Strategy Specifics

In April, Earnio deployed 10 algorithmic strategies trading across 19 liquid pairs, resulting in just under 250 trades.

These 10 strategies are primarily long-oriented (80% long, 20% short). We still view the market as more bullish and adjust our strategies accordingly.

They are not designed to mimic market moves precisely, but rather to trade the market actively. Our trades are not always closed on the last day of the month, but based on predefined strategy parameters. This can result in slight delays in performance reporting—for example, if the market grows or drops, Earnio’s reflection of that movement may come slightly later depending on how positions are closed.

Crypto market review – May

May was a pivotal month for the cryptocurrency market, characterized by a robust recovery and renewed optimism.

Bitcoin reclaimed its six-figure price milestone, driven by easing macroeconomic tensions and strong institutional demand. Ethereum, bolstered by a significant network upgrade, staged an impressive rally, though it trailed Bitcoin’s year-to-date gains. Altcoins also gained traction, with capital rotating into the broader market as investor sentiment shifted from caution to exuberance.

In this review, we analyze May’s key market movements, macroeconomic catalysts, Bitcoin and Ethereum trends, sentiment shifts, and critical fundamental signals shaping the crypto landscape.

Major market movements in May

The cryptocurrency market in May 2025 saw a significant upswing, led by Bitcoin’s climb above $100,000. Starting the month around $92,000, Bitcoin reached $101,330 by May 8, a 4.7% gain, marking a recovery from April’s lows.

The momentum continued, with Bitcoin hitting a new all-time high of $111,950 on May 22. Despite a brief pullback, it closed the month around $105,000, up 20% for May. Bitcoin’s 90-day price volatility dropped to its lowest since the ETF era began, signaling growing market maturity as institutional players entered.

Ethereum followed with a slower but notable rebound. Starting May at ~$1,850, ETH jumped 14% in the first week to $2,050. By mid-month, it was still 50% below its late-2024 peak of ~$4,000, but it gained traction later, surging to $3,780 by May 23, nearly doubling from March lows and achieving an 80% monthly gain. This rally narrowed the performance gap with Bitcoin, though ETH remained below its all-time high.

ETH intraday movements painted more than 100% gain in last 2 months. ETH is still lagging though behind its all time high of nearly 4900 USD. Source: tradingview.com

Key macroeconomic developments

May’s crypto rally was supported by a more favorable global macroeconomic environment, shifting sentiment to risk-on. A key development was the easing of U.S. trade tensions, with negotiations signaling a retreat from protectionist policies.

In Asia, China’s economic policies provided a tailwind. Authorities introduced measures to counteract trade-war damage, including liquidity injections. These coincided with U.S.–China trade talks, lifting global markets. Chinese equities surged, and risk assets like Bitcoin benefited.

Bitcoin’s resurgence and trends

Bitcoin was the standout performer in May:

Price and dominance: Bitcoin’s climb from $74,000 in early April to $111,950 by May 22 was a remarkable recovery. Its dominance hit 65% early in May, reflecting its role as crypto’s safe heaven. As the rally broadened, dominance eased little bit indicating capital rotation into some altcoins.

Bitcoin dominance refers to the percentage of the total cryptocurrency market capitalization that is made up of Bitcoin, indicating its relative strength compared to other cryptocurrencies. Source: tradingview.com

Institutional inflows

U.S. spot Bitcoin ETFs saw strong demand, adding significant BTC to their holdings. BlackRock’s iShares Bitcoin Trust (IBIT) led, holding substantial assets and stabilizing prices. Net inflows reached high levels, reducing volatility.

The image from Coinglass illustrates Bitcoin's inflows over time, highlighting trends and shifts in market sentiment and investor activity. Green are inflows and red are outflows. Source: coinglass.com

On-chain signals

Exchange BTC balances dropped significantly, reflecting strong HODLing by whales and institutions. Whale wallets expanded, though some dormant coins moved late in May, hinting at profit-taking.

Short squeeze and liquidity

Bitcoin’s surge above $100,000 triggered significant short liquidations, adding fuel to the rally. Futures trading volumes rose, but neutral funding rates suggested a sustainable rally with limited leverage excess.

Bitcoin ended May with strong momentum, though questions lingered about sustaining six-figure prices without consolidation.

Ethereum’s rebound and developments

Ethereum began May in Bitcoin’s shadow but gained momentum with a network upgrade and market tailwinds. Starting at $1,850, ETH rose to $2,050 by May 8 and surged to $3,780 by May 23, almost doubling from March lows. While it didn’t break its $4,800 high from 2024, ETH outperformed Bitcoin over certain stretches, with the ETH/BTC ratio recovering.

Activated on May 7, Pectra update increased the staking cap to 2,048 ETH per validator, streamlining institutional participation. It enhanced smart contract functionality and network throughput, addressing competitive pressures. Ethereum ETF funds even saw significant inflows, with BlackRock’s Ethereum Trust leading.

Shifts in investor sentiment

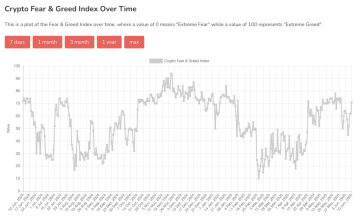

Investor sentiment transformed dramatically in May. The Crypto Fear & Greed Index moved from 60–70 (Greed) early in the month to Extreme Greed (above 75) by May 23, driven by Bitcoin’s $100,000 breakthrough.

Social media buzzed with bullish memes, and Google searches for “Bitcoin” spiked. A late-May pullback cooled the index to the mid-60s, reflecting healthy moderation.

Shift in investor sentiment can be clearly seen in mid April as market turned on its risk tolerance. Source: https://alternative.me/crypto/fear-and-greed-index/

Altcoin outperformance signaled growing risk appetite. The resolution of the SEC vs. Ripple case and a U.S. Bitcoin policy summit reinforced regulatory progress. Community sentiment shifted from Q1’s fear to May’s exuberance, though cautious profit-taking kept markets relatively balanced and without any crazy leverage.

June 2025 outlook and conclusion

As June begins, the crypto market carries strong momentum but faces tests. Upcoming trade talks and the Fed’s June meeting will be critical. Bitcoin’s technicals suggest potential consolidation, with support at $95,000–$100,000. We can see another leg up forming just now. If bitcoin now pauses but does not creash, we could see an altcoin season, even if not on all altcoins at the same time.

Sentiment remains bullish but. Investors should monitor macro data and on-chain signals. May’s rally demonstrated crypto’s resilience, and with institutional backing, 2025 could bring further upside. However, volatility remains, and prudent risk management is key.