Earnio results june 2025

7 months ago

Tomáš Hucík

In June 2025, the Global cryptocurrency market as tracked by Coingecko page faced a turbulent macro backdrop, yet in the end managed to post a modest overall gain of 1.9%. This was hugely thanks to Bitcoin posting monthly result of +2.5%

This Bitcoins stability contrasted with Ethereum and most altcoins, which underperformed as investors leaned toward larger, more defensive assets like Bitcoin. Despite growing institutional interest in Ethereum and selective rallies among certain altcoins (that is clearly starting to show in the first half of July), Bitcoin's performance dominated the market in June.

We still identify this market as bullish (and the development from the first half of July agrees with us) and therefore our algorithmic strategies are tilted for more the upside movement. They are though spread out more over 20 altcoins banking on the possibility of a broader altcoin run that would bring in greater payout. (Based on our simulations this comes as the best statistically possible outcome or as best EV trade.)

During the month of June 2025 our automated algorithmic trading strategies did 219 trades.

With a win rate of 39.46% our result was -5.19% for that month.

With such a win rate for this month one might expect the result for the month would be way worse, maybe even double digit.

That did not happened though.

That is the beauty of (algorithmic) trading. The key to our success is not necessarily focusing on achieving a higher win rate but instead ensuring that our profitable trades outweighed the losses.

Even thought that this did not happen last month month, the losses were relatively small thanks to strict and precise risk and position management.

In terms of the mentioned risk management, our fund adheres to a strict protocol of limiting each position's risk to a maximum of 0.5%.

This approach helped us maintain stability, even during periods of volatility. Our worst trade of the month was a loss of $9,542, which was just about 0.5% of our portfolio, staying true to our risk management rules.

Biggest loosing trade of June 2025. The EWO strategy, which seeks to trade a return to the trend, opened a LONG position on the UNIUSD pair, but the price did not continue to rise in the middle of the month, so the trade was automatically closed at the protective Stop-Loss order.

The average loss across all loosing trades was $1,870.11, that means it is roughly 0.1% of our portfolio. This approach of strict management allowed us to weather the mid-June geopolitical shock of Isreal attacking Iran, where bitcoin briefly dipped below $100,000 but quickly regained momentum back.

The risk, or potential loss is strictly managed and always limited, meanwhile the upside, especially on LONG trade is virtually uncapped, because the trade can run away with gains and in many cases is closed typically after the move is exhausted only.

That is why winning trades are generally bigger than those loosing ones.

Example of winning trade in the same pair UNIUSD, this time by the strategy RFR that caught the upside movement and closed the position only after the move was exhausted.

This detailed risk-adjusted approach enables us to take advantage of Bitcoin’s relative stability, while keeping losses controlled and ensuring that profitable trades continue to drive overall performance, even in a market dominated by uncertainty and geopolitical shocks.

The point of algorithmic trading is not making every month a hit but, in a sum, over period of a longer time, prevail on top. I strongly believe that based on current market trends this might materialize in July results.

Crypto Market review - June

After May’s explosive rally, June 2025 saw crypto prices consolidate in a higher range with intermittent volatility. Bitcoin opened the month near $105,000 and traded in a relatively tight band early on, as traders awaited mid-June economic decisions. A mid-month geopolitical shock momentarily jolted the market – U.S. airstrikes in the Middle East on June 22 sent Bitcoin briefly below $100,000 and triggered over $1 billion in leveraged liquidations.

However, buyer support kicked in swiftly, and the dip proved short-lived. By late June, bitcoin regained momentum, climbing to about $107,000 and closing the month with a ~3% monthly gain – its smallest monthly increase in a year, but a testament to its stability after recent highs https://www.coindesk.com/markets/2025/06/27/bitcoin-faces-weakest-monthly-growth-since-july-as-whales-counteract-etf-inflows.

Ethereum followed a similar trajectory: it rallied to nearly $2,900 by June 11 amid early optimism, then plunged to around $2,450 at mid-month as global tensions sparked a broad sell-off. Despite bouncing off those lows, ether finished June near $2,475 (down roughly 2–3% for the month)

The overall crypto market caphttps://www.coingecko.com/en/global-chartsended around $3.4 trillion – a low-single-digit percentage increase month-on-month – signaling that June was a period of consolidation following May’s robust recovery. Volatility flared only briefly during the mid-June scare, and the market’s quick rebound highlighted improving liquidity and investor confidence in the longer-term uptrend.

Global macroeconomic cues in June were mixed, but generally supportive of crypto’s resilience. On June 18, the U.S. Federal Reserve held its benchmark interest rate steady at 4.25–4.50%, refraining from further hikes amid signs of cooling inflation.

However, geopolitical risks reminded investors to stay vigilant. In the Middle East, an escalation on June 22 (U.S. strikes on Iranian nuclear sites) briefly rattled markets and sent oil prices higher.Bitcoin’s swift dip below six figures on that news showed crypto is not immune to such shocks, though the quick recovery underscored their transient impact.

On the regulatory front, there were also constructive developments: U.S. lawmakers advanced the GENIUS Act to establish a framework for stablecoins, a move that was seen as legitimizing the sector. The stablecoin market’s supply grew ~2.5% in June on the back of this news, as USD-pegged coins like USDC gained confidence (even though USDT remains the dominant stablecoin). Overall, macroeconomic and policy signals in June – from central bank accommodation to trade peace and clearer crypto regulations – helped create an environment in which the crypto market could hold on to its gains despite isolated turbulence.

ETF

A key theme of June was the sustained wave of institutional capital flowing into Bitcoin-related investment products, which helped stabilize prices and dampen volatility. Crypto exchange-traded funds and trusts enjoyed robust inflows, extending the trend from previous months.

Notably, U.S. spot Bitcoin ETFs saw about $4.5 billion in net new capital during June – a record monthly haul – as large investors took advantage of mid-month price dips to increase their exposure. In fact, a single day in June saw nearly $1 billion flow into Bitcoin ETFs, highlighting strong institutional appetite whenever Bitcoin pulled back. This consistent demand, led by major fund issuers, has further strengthened market liquidity and price support.

Inflows into bitcoin ETFs continue. Source: Coinglass.com

These institutional inflows have had tangible market impacts. By absorbing coins during sell-offs, funds have acted as a backstop for BTC’s price, reducing the depth of corrections.

Crucially, June witnessed a notable uptick in institutional interest in Ethereum, suggesting that smart money may be positioning for an Ethereum rebound. According to fund flow data, Ethereum-focused investment products attracted about $1.16 billion in net inflows during June.

Fear and Greed index

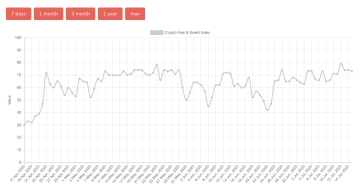

Investor sentiment in the crypto market remained cautiously optimistic throughout June, albeit less euphoric than in late May. In the first half of the month, sentiment was tested by macro and geopolitical anxieties – for example, news of conflict in the Middle East and recessionary fears initially kept the Crypto Fear & Greed Index in check. However, as those worries abated and markets found a new equilibrium in the second half of June, sentiment began recovering. By month’s end, many metrics pointed to a neutral-to-positive mood: the Fear & Greed Index hovered back in the Greed zone.

Fear and Greed index is showing optimism on the rise. Zdroj: alternate.me

That said, investors are still far from reckless, and their behavior in June reflected a selective risk appetite. Broadly, market participants favored large-cap, fundamentally solid projects over speculative altcoins. When volatility struck, they rotated into Bitcoin (and to a lesser extent Ether) rather than chasing small-cap tokens. Many altcoins actually underperformed; for instance, Cardano (ADA) and Dogecoin (DOGE) suffered double-digit percentage losses in June amid project-specific setbacks and profit-taking

July 2025 outlook

In july, we can see global liquidity to continue its growth and therefore economic enviroment turning more bullish for risk assets. As pressure of Donald on FED to lower the rates gets stronger, more investors try to frontrun actual cut by buying scarse and more speculative assets.

This positive outlook for cryptocurrency can be easily dampened by the everlooming possibility of a war conflict (be it Ukraine, Iran, Taiwan or others,…or by new tarrfis that always cause risk-off at least temporarily until trader and investors can actually process the information.

This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies are highly volatile and can be associated with the risk of loss of capital. Before making any investment decisions, it is important to consult with a professional and conduct your own research. Probinex is not responsible for any losses that may arise from investments in cryptocurrencies.