Earnio results for August 2024

1 year ago

Tomáš Hucík

Quite a lot has been written and said about the market downturn at the beginning of August.

This drop, caused by the unconvincing figures in the US economy and the situation in the Japanese market, has shown nicely how volatile global markets can be.

Rather than repeating what I wrote in the StayKing article, or what Adam and I talked about , let's take a slightly non-traditional look directly at the chart to see how our strategies have handled this situation.

You can read the picture as our algo strategies had accrued LONG positions at the beginning but they gradually closed at a loss. An example is this trade on BNBUSDT, which entered on a small increase but it was slammed with a stop-loss on the decline.

But where the strategies worked well is that they did not increase the loss. It seems trivial, but risk management is even more important in professional investing than the "brilliant" idea itself. So, at the lowest point in the market, the loss was only something like minus $70,000, which is not even 1% of the entire portfolio.

When the market momentum turned, the first strategy to capture the reversal was GGS. It is our most active strategy that trades short and probable moves in the direction of the trend, currently enabled to trade only in the uptrend. So it managed to trade this rise nicely. This strategy didn't catch it immediately, but when an uptrend started to form on her lowest timeframe, GGS jumped in. You can see an example here on the ETHUSD trade.

After the price returned to the price level of around $60,000, even our strategies started to gradually close out the gains. The market recovered and started to advance sideways again for a few days and after it became clear that the US economic results might not be so bad, the BTC price spiked just below 65,000 USD for a while. But even here, it returned to its balanced position and started to gradually drop off over the last week.

This last drop just before the end of the month gradually wiped out all our open profits, and the algorithmic strategies closed the month in a small loss.

Currently, the market has been at a crossroads for several months and traders are looking for a signal as to which way it may go.

Interestingly, macroeconomic data is really sort of "indecisive".

Add to that the unfortunate US election, where it also currently looks probabilistically like a coin toss.

I like a lot this post by Alex Kruger in which he predicts what the potential developments are based on economic results.

The problem is that we are really somewhere in the middle. Last week's U.S. employment numbers were below expectations, but still mediocre. US inflation came in as expected this week. There was no jump there. And interest rates in the U.S. will be announced next week, probably a 25 or 50 basis point cut.

This would really throw us somewhere in the middle of the table, where there's no telling how it might turn out.

On the other hand, there is a lot of positive news and data. The supply of liquid money in circulation has recently started to rise again. This has historically been a foreshadow of the rise in the price of bitcoin. Some people are attributing the cyclical nature of the bitcoin price to halving, and some are attributing it to this increase in the money supply.

The truth is that both factors have a fact-based and easily explained effect. Halving reduces the amount of BTC paid to miners for mining a block, so it reduces bitcoin inflation. Increased money supply in circulation in turn means you have more money with which to buy assets.

There are simply cycles of contraction and expansion in the economy. The markets are now at a crossroads, deciding which direction to take, and they are either pausing in place or going slightly down in nervousness.

So we are basing our business thesis on that assumption, which I would summarize roughly as follows:

If the market is at a crossroads and at that it goes sideways and slightly down, we are willing to absorb even a possible small loss at the cost of clearly catching the price run up and bullrun.

However, in the event that the price upturn does not happen and instead there is a downturn and a recession, we have verified on strategies (also by what has happened now in early August) that any downturn will not create a big loss and allow us to switch to strategies that trade the downturn.

Well, then why do we have strategies set up to catch mainly the upside so far?

We are assuming that the surge will cover those potential losses. It's the result of a risk vs. reward ratio. It may not work, and the market will go down. That's what we're counting on.

We assume that the reward when markets go up will exceed the risk when markets go down or continue to go sideways. And it will also exceed the eventual reward if we try to trade directly into that sideways move.

But of course, we constantly scrutinise our business thesis and assess it in the light of new facts and data. But for now, it holds.

How long can a similar condition last?

It is difficult to predict. We will get the first answers with the US interest rates next week. The second important event will be the US presidential election. A Donald Trump victory would be a price catalyst for the crypto industry at least in the short term. In the event of a Kamala Harris victory, it could be even more complicated.

So why do we have strategies set up to capture the increase so far?

As mentioned, we're basing it on some market cyclicality (mentioned above), but also on other indicators that are slowly turning bullish again.

One such indicator is a chart of whether miners are selling or holding mined bitcoins.

Well, it looks like they have now stopped selling after a long time.

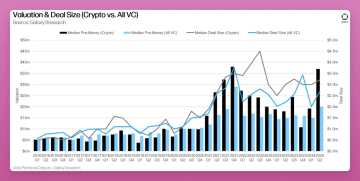

Venture fund investments in the crypto sector are also currently higher than the average venture investment in start-ups. This means that funds don't want to miss out on this type of investment.

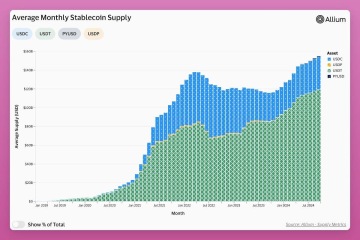

The stock of stablecoins in circulation is also rising. This essentially means an increase in funds in the crypto world that are ready to be used to buy cryptocurrencies.

Two things are interesting here. The first is that USDC's stake isn't growing as much because Circle, as a US company, is suffering quite a bit from pressure from the regulator there, whereas Tether doesn't have regulation. The second interesting fact is the creation of PYUSD, which is a stablecoin issued directly by Paypal. Yes, one of the biggest payment companies, Paypal, has its stablecoin too. Although its share is still small, it is starting to increase.

Our non-vector portfolio components, those that are not primarily driven by market conditions such as market making or arbitrage, saw small gains, reversing the loss generated by algorithmic trading. This component also plays an important role in portfolio stabilisation.

Earnio's result for the month was: -0.14%.