Earnio results for January 2025

1 year ago

Tomáš Hucík

January was a very interesting month for Earnio. Within our infrastructure, we are preparing for the split of our portfolio between different programs and the related adjustment of our strategies. Despite these operational developments, we have not taken our eyes off the market. And despite the unconvincing market structure and declining sentiment, we managed a nice result of 3.49%.

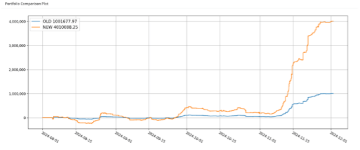

Increasing risk in Dynamic

Within Earnio Dynamic, we are gradually increasing the risk per trade. In simple terms, our trades will open larger positions. If the trade succeeds, the profit will be multiple times higher but so could be a potential loss. Here you can see the simulation for the last few months.

Please note that this is merely a simulation based on real historical data, modeled under a scenario where the risk is quadrupled. It is not a forecast, nor does it imply that these strategies will consistently behave in the same manner.

Spot crypto in Earnio

Currently, Earnio holds major spot cryptocurrencies such as BTC, SOL, and ETH, primarily positioned for longer-term swing trades. The objective is to strategically manage these positions, gradually securing modest yet consistent profits to complement the now-closed FIX strategy.

Bitcoin and the inauguration effect

January saw heightened market uncertainty, as evident from the chart. Investors were on edge in anticipation of Donald Trump’s inauguration—yet paradoxically, this moment coincided with Bitcoin reaching an all-time high of nearly $109,000 per coin.

From this point on, however, the market turned and began to move in the opposite direction.

The inauguration thus became a textbook example of a ("buy the rumor, sell the news") event. Experienced market participants are well aware of such dynamics: when an event is widely anticipated and its timing is known, the market often prices it in advance—especially if the event is perceived as positive. As the actual date approaches, volatility surges as traders attempt to lock in profits and sell before the broader market does. Leading up to these sell-offs, speculators continue buying, convinced they can still enter and exit profitably before the majority begins offloading their positions.

However, once the event unfolds, it rarely brings any fundamental change—after all, "bread doesn’t suddenly become cheaper out of thin air." As this realization sets in, traders shift their focus to profit-taking, triggering a market-wide correction. You can see it on the chart now, but we have seen it many times before. In May 2021, prior to Elon Musk's appearance on Saturday Night Live, the price of Dogecoin rose sharply but then also fell rapidly. Or for example the Alonzo upgrade in September 2021 to the Cardano blockchain the anticipation of the introduction of smart contracts increased the price of ADA, but the launch of the upgrade was followed by a drop due to profit taking.

Source: tradingview.com

Fear and greed on the market

Traditionally, the Fear and Greed index has been an important metric for assessing market sentiment. This index aggregates multiple metrics to gauge the balance between market greed and fear. Currently, it suggests that the market is gradually stabilizing after the peak reached around Donald Trump's election victory. Despite this cooling-off period, the index remained above 70 until the end of January—an indication of sustained greed.

A decisive drop below this threshold did not occur until early February, signaling a shift in sentiment.

Trump's tariffs and Bitcoin's decline

Corresponding with the overall market decline, on the first weekend of February, US President Donald Trump announced tariffs of 25% on imports from Canada and Mexico and additional 10% on Chinese goods. This move triggered an immediate reaction in the financial markets, and also in the cryptocurrency sector, which is hypersensitive to macroeconomic events and changes in global trade policy. Bitcoin lost around 15% of its value in a matter of hours. This fall was accompanied by high liquidations of leveraged positions on derivatives exchanges, where billions of dollars were lost.

The first announcement of the tariffs led to a stronger US dollar, and a stronger dollar usually reduces the attractiveness of risk assets, which led to a wave of sell-offs among investors. However, when Trump announced at least a temporary suspension of tariffs on Mexico and Canada, bitcoin quickly recovered, and its price crossed back over the $100,000 mark. However, this turnaround came after billions of dollars were flushed out of the market, mainly from highly leveraged traders.

Analysts point out that Trump's trade policies have been one of the main factors that have affected the volatility of financial markets, including cryptocurrencies, in the past. Similar situations played out during his former presidency, when the announcement of tariffs on Chinese goods in 2018 and 2019 triggered sharp reactions on stock markets. The question now is whether similar moves will become the norm during his second presidential term.

Bitcoin ETFs support the market

The positive news is that bitcoin ETFs continue to experience a good period where inflows outweigh outflows. Investors in ETFs tend to have a longer-term horizon in mind and thus are more resilient to short-term fluctuations. These institutional inflows are thus keeping the value of bitcoin afloat, so to speak, even though the regular retail market may capitulate.

The problem comes regarding altcoins, which are not yet in such high demand among institutional investors. And while bitcoin makes, for example, -2%, altcoins will fall by -10%. Meaning that what I wrote a few months back on my twitter account is true.

It's relatively simple. Some of the older cryptocurrencies probably won't even look back to their peak price. The amount of circulating coins has risen so much for them that reaching back to the ATH will no longer be possible as it would take too much money to do so.

The altcoin market is grappling not only with the dilution of supply within individual cryptocurrencies but also with the fragmentation of the ecosystem as a whole. With an ever-expanding landscape that includes dozens of Layer 1 blockchains, hundreds of Layer 2 solutions, thousands of token projects, and an endless flood of valueless memecoins, genuine winners will be increasingly rare. In such an oversaturated environment, strategic selection is paramount for those looking to allocate capital to altcoins. The era of indiscriminately picking any cryptocurrency and watching it appreciate by double or triple digits is long gone.

Ethereum versus Solana

Even the second-largest cryptocurrency, Ethereum, is facing significant challenges. It is under increasing competitive pressure from alternative blockchain platforms, particularly Solana. As a result, discussions within the Ethereum community have intensified regarding the urgency of scaling solutions and user experience enhancements to maintain its dominance in smart contracts and DeFi.

Ethereum has been criticized for prioritizing theoretical discourse and technological refinement over practical adoption and tangible benefits for users and investors. One of the key initiatives aimed at scaling was the introduction of blob mechanics, designed to enable Layer 2 solutions to write data to the Ethereum blockchain at a significantly lower cost. The intent was to facilitate faster transactions on Layer 2 networks while preserving security through the base Ethereum layer.

However, an unintended consequence emerged: the transaction fees paid by Layer 2 networks for these blobs were so minimal that they failed to offset the revenue loss from users migrating away from the Ethereum mainnet in favor of cheaper alternatives. As a result, Ethereum has inadvertently weakened its own economic model through its own technical advancements.

Ethereum Foundation's DeFi strategy

One of the initial steps to counteract this trend is the Ethereum Foundation’s decision to engage its treasury in DeFi. Despite holding a substantial reserve of ETH, the foundation had, until now, refrained from utilizing it. However, a shift in strategy has led to the allocation of 50,000 ETH across various DeFi applications to generate yield, with the profits reinvested into Ethereum’s development.

This move, however, raises three critical questions.

Why was this step not taken earlier? Will it be sufficient to shift the broader market sentiment surrounding Ethereum? And perhaps most importantly, which DeFi protocols will be chosen? The selection process inherently grants preferential treatment to certain projects, potentially reshaping.

So that was January. If you want to be there in February, feel free to visit www.earnio.com.