Earnio results for September 2025

4 months ago

Tomáš Hucík

The cryptocurrency market was back in the green in September 2025. Although Bitcoin did not exceed its historic August high, it stabilized around USD 115,000 at the end of the month, representing an increase of approximately 5% for September. The total market capitalization of cryptocurrencies grew by approximately 4%, and the Binance index of the 10 largest cryptocurrencies with equal weighting gained 2.49%. On the other hand, some cryptocurrencies weakened – for example, Ethereum, which fell by approximately 4%.

The result of our Earnio Dynamic in September 2025 is +6.07%

The most important thing, though, is to monitor long-term indicators and not succumb to emotions. Earnio Dynamic has an average annual trading result of over 33%.

A client with the most favorable conditions would thus achieve an average annual return of up to 20.59%.

Our strategy and results

As I have emphasized before, the goal of algorithmic trading is not to "win" every month, but to achieve strong performance in the long term, and this is clearly evident here.

The trigger for a partial improvement in market sentiment in September was the interest rate cut by the US Federal Reserve (Fed) after a nearly year-long pause, which encouraged investors to take more risks. However, September's growth was not entirely straightforward. Before the Fed meeting, the market strengthened significantly, but after the announcement itself, it gave up some of its gains as part of the classic "sell the news" effect. Even so, longer-term expectations remain optimistic, as lower rates traditionally increase the attractiveness of risky assets. This is also due to the gradual easing of monetary policy in the US.

In this market environment, we continued exactly according to plan and maintained a predominantly bullish orientation for our portfolio. We currently have seven trading strategies in place, trading approximately 20 different cryptocurrencies.

During September 2025, our algorithmic strategies executed a total of 294 trades. Our success rate for the month was 42.2% (124 profitable trades vs. 170 losing trades). Despite a success rate of only ~42%, our disciplined risk management kept our results comfortably in the black. Crucially, the average profits from successful trades significantly exceeded the average losses from losing positions. In September, the average profit per winning trade was approximately $2,045, while the average loss per trade was $1,056. This ratio of nearly 2:1 meant that even with a success rate of around 42%, total profits outweighed losses. In other words, our set rules for stop-loss and loss limits worked exactly as intended. This is also the beauty of systematic algorithmic trading. It may seem counterintuitive, but thanks to professional strategy management, even a portfolio with a lower win rate can remain profitable.

Risk and loss management

Negative results were carefully monitored throughout the month, and no single loss was allowed to grow unchecked. The maximum risk per position remains limited to 1% of capital. Even that occurs only in exceptional cases; typically, individual positions risk even less, with the average loss per trade corresponding to roughly 0.05% of capital. No single trade can therefore cause a significant drawdown for the entire portfolio. This consistent discipline allows us to overcome even difficult periods and remain prepared for market recovery.

The best and worst trade

Our best trade in September was executed by the CGR strategy on the DOGEUSDT pair. It was a long position on Dogecoin, one of the most famous alternative meme cryptocurrencies. Dogecoin strengthened significantly in the first half of September thanks to increased investor interest following the announcement of the first ETF linked to this cryptocurrency. The CGR algorithm identified this upward trend in time and opened a long position (DOGEUSDT) around September 5. We closed it on September 15 after Dogecoin reached a local peak. This single trade captured approximately 28% of Dogecoin's price increase and generated a profit of around $13,700. This mean-reversion strategy effectively took advantage of Dogecoin's short-term rise in September and demonstrated the power of a systematic trading approach during a period of increased altcoin volatility.

A profitable trade that capitalized on speculators' interest in a potential DOGE ETF fund. Source: tradingview.com

Our worst trade also took place on the DOGEUSDT pair, but this time it was a short position opened with the GGS strategy. At the beginning of the month, this strategy attempted to exploit Dogecoin's short-term decline (the strategy aims to trade trend continuation, i.e., that the price will keep falling), which, however, soon turned into a sharp rise. The altcoin market unexpectedly strengthened in the first days of September, which meant that this short position was closed with a loss of around $7,200. This result underscores the reality of trading: even with the best systems, there will be losing trades, especially when market conditions suddenly shift against your position. However, it is important to note that the loss was quickly limited in accordance with our rules – even our worst trade did not exceed the set risk limits and did not have a significant impact on the overall portfolio capital.

Key macroeconomic events

Bitcoin posted solid growth of approximately +5% in September 2025, with its price moving from around $108,000 to more than $114,000 at the end of the month. However, the path was quite volatile – at the beginning of September, BTC strengthened in anticipation of favorable macro data (a weaker US labor market increased bets on a Fed rate cut), and around September 18, it reached a new all-time high. This was followed by a sharper correction: Bitcoin fell back to levels around $108,000 (just above the level at the beginning of the month). In the last days of September, buyers returned to the market and BTC showed an upward rebound, offsetting some of the losses from the correction.

Bitcoin plummeted in the middle of the month and only managed to recover in the last few days of September. Source: tradingview.com

In terms of trading volumes, the most activity occurred during price fluctuations – in mid-September during euphoric growth and then again during the sell-off, pointing to the entry of higher liquidity (and probably algorithmic trades) at key moments.

Institutional interest in Bitcoin continued to grow – an example is the flow of money into exchange-traded funds: Bitcoin ETFs recorded a net inflow of approximately $3.51 billion in September. This is an above-average result, suggesting that despite macroeconomic turmoil, Bitcoin is increasingly perceived by institutional investors as a safe haven and a store of value.

The largest outflow from BTC funds occurred on September 26 (–$418 million) during peak uncertainty surrounding the US budget and the threat of a government shutdown – showing how macro events can affect sentiment and capital flows in the short term. However, this is nothing new. Overall, Bitcoin strengthened its position in September. Price growth and continued institutional interest underscore its role as the market leader.

Source: coinglass.com

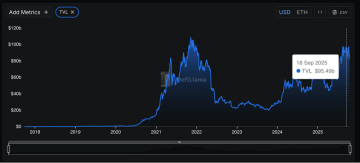

Ethereum also experienced increased institutional interest, albeit more modest than Bitcoin. ETFs focused on Ethereum reported a net inflow of approximately $286 million in September – which is positive, though smaller compared to Bitcoin. Some institutions realized profits on ETH after strong summer growth, and the overall appetite for investing in Ether was somewhat dampened by an uncertain macroeconomic environment. However, at the end of the month, specifically on September 29, Ether funds recorded a record daily inflow of $547 million, signaling that large buyers stepped in as prices dropped – possibly driven by an arbitrage effect (capital rotation from gold, which was rising sharply at the time, into undervalued ETH) and a change in the Fed's tone toward a more accommodative policy. On-chain data shows that the total value locked (TVL) in the Ethereum ecosystem (DeFi projects) continued to grow in September, supporting demand for ETH as collateral. Ethereum staking continued to offer yields of up to 6% per annum, which may have attracted additional capital.

Source: defillama.com

Market sentiment

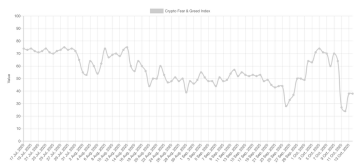

Market sentiment in September experienced significant reversals – from optimistic euphoria to caution and fear. The beginning of the month was characterized by surprisingly strong sentiment, despite September historically being a difficult month for the crypto market. This time, however, macroeconomic reports gave the markets hope: weaker data from the US labor market and falling inflation increased expectations that the Federal Reserve would begin cutting interest rates. This prospect of cheaper money created a risk-on environment, where investors were more willing to take risks, benefiting cryptocurrencies.

By the end of the month, however, caution prevailed. On September 26, amid reports of a stalemate over the US budget, capital outflows from crypto funds intensified and market uncertainty grew. The Fear and Greed Index dropped to around 30 points, entering the fear zone. Investors realized that after rapid growth, markets had become vulnerable and negative news could trigger larger sell-offs. Gold rose to a new all-time high above $3,500 per ounce – the rise in gold prices (a traditional safe haven) shows that some investors began hedging against risk.

Fear and Greed Index plummeted towards the end of September. Source: alternative.me

Future market developments

The crypto market is entering the end of 2025 with several important external factors that could influence its trajectory. Attention is focused on the next moves by central banks – interest rates in the US are expected to continue falling, but investors are closely monitoring every statement from the Fed amid concerns that excessive easing could reignite inflation. Geopolitically, the key issue remains trade tensions between the US and China, as well as potential escalations of other conflicts (global markets are still watching developments in Ukraine and the Middle East, though their direct impact on crypto has been limited so far). The US–China trade war proved to be a major risk for markets in early October – highlighted by the dramatic drop over the weekend of October 11–12.

On Friday, October 10, US President Donald Trump unexpectedly announced the imposition of additional 100% tariffs on all Chinese goods, effective November 1, in retaliation for China's restrictions on rare metal exports. This escalation of the trade war – announced after traditional financial markets had closed – hit cryptocurrencies with full force.

The market erased most of its September gains during that “Black Saturday.” From the perspective of derivatives liquidations, it was an unprecedented event – over $19 billion in trading positions, mostly long, were liquidated within 24 hours. This was several times higher than during previous record sell-offs (for comparison: during the FTX exchange collapse in November 2022 or the pandemic crash in March 2020, liquidations totaled only $1–2 billion).

This October slump offered several lessons.

First, macroeconomic and geopolitical events can still have a strong impact on cryptocurrencies – although Bitcoin is often labeled an uncorrelated asset or digital gold, in times of acute stress, global capital moves in unison and crypto assets are sold off alongside other risky investments.

Second, when stress periods fall on weekends, cryptocurrencies are hit hardest, as they are the only assets that can still be traded while stock markets remain closed.

Third, the record volume of liquidations revealed that many market participants were trading with high leverage – a factor that can amplify gains during calm periods but trigger cascading losses during reversals. Regulators and exchanges may consider tightening margin trading requirements to prevent similar market overheating.

For investors, this serves as a reminder of the importance of proper risk management. On the positive side, the long-term trend remains intact – the drop was essentially a technical reset, after which the fundamental strengths of cryptocurrencies remain unchanged.