Earnio results for October 2025

3 months ago

Tomáš Hucík

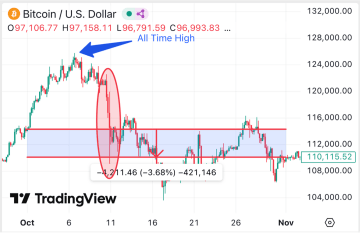

The cryptocurrency market found itself in the red in October 2025. Bitcoin actually surpassed its historic high, but in the middle of the month, the largest crash in the history of derivatives exchanges occurred.

The huge slump in the middle of the month meant that Bitcoin ultimately lost 3.69% in October. Source: tradingview.com

At the end of the month, when the dust settled, Bitcoin ended October down 3.69%. The total market capitalization of cryptocurrencies fell by approximately 7.53%, and the Binance index of the ten largest cryptocurrencies with equal weighting fell by as much as 9.7%.

The result of our Earnio Dynamic is -1.49% in October 2025.

The result clearly shows how well Earnio dealt with extreme volatility.

Our strategy and results

October was a month when crypto trading and algorithmic funds really suffered and their risk control literally exploded. However, we managed to control the risk well, and the decline of tens of percent on various altcoins had almost no impact on our portfolio.

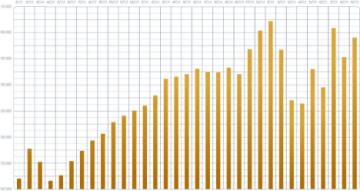

Earnio Dynamic has an average annual compound growth rate of over 33%. A client who had the most favorable conditions from the beginning of Earnio would thus achieve an average annual compound return of up to 19.17%.

Development of an investment of 100,000 USDC under the most favorable client conditions. Source: earnio.com

As I regularly emphasize in my articles, the goal of algorithmic trading is not to "win" every month, but to achieve strong performance in the long term, and this is clearly demonstrated here, where even in a negative month in one of the most complex market narratives, our strategies performed reasonably well.

We currently have seven trading strategies in place, trading approximately twenty different cryptocurrencies. During October, our algorithmic strategies executed a total of 306 trades. Our success rate for the month was 34.2% (104 profitable trades vs. 202 losing trades). Even with only a 34% success rate, our disciplined risk management kept losses low.

It may be a little counterintuitive, but thanks to professional strategy management, even a portfolio with a lower win rate can perform well. Negative results were carefully monitored throughout the month, and no single loss was allowed to grow unchecked.

The maximum risk per position is still limited to 1% of capital, and even then only in exceptional cases. Typically, individual positions risk even less. The average loss per trade mentioned above corresponds to more like 0.05% of capital. No single trade can therefore cause a catastrophe for the entire portfolio. This consistent discipline allows us to overcome even more difficult periods and be ready for market recovery.

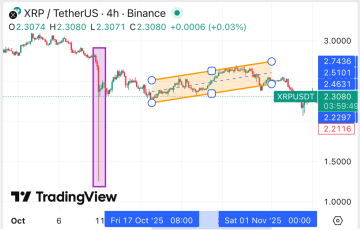

Chart of the XRP cryptocurrency, on which we made our biggest profit in October. Source: tradingview.com

Our strategies on the XRPUSDT pair were the most successful, with the strategies generating a profit of over $50,000. XRP rose nicely after a huge washout on all altcoins in the middle of the month and showed significant strength, which allowed our strategies to capitalize nicely on this movement. Other pairs did not achieve such results, but the pairs with negative results did not exceed -$20,000.

From this perspective, it is easy to see how important proper risk management is.

Key macroeconomic events

At the beginning of October, there was a significant macroeconomic shock when President Donald Trump announced a 100% tariff on Chinese imports, escalating the trade war between the US and China. This surprising "tariff shock" affected all risk markets and immediately shook cryptocurrencies.

Bitcoin, which had been rising sharply thanks to optimism, fell from ~$126,000 to just under $102,000 during the worst sell-off on October 10 and 11. Ethereum and other altcoins were also pushed down—ETH fell by approximately 17% during the same period (from ~$4,700 to ~$3,900). Within a few hours, about $19 billion in leveraged positions were wiped out on exchanges. This flash crash following Trump's threat to impose tariffs is now the largest one-day drop in the history of cryptocurrencies in terms of losses, surpassing even the worst days of 2020 and the collapse of FTX in 2022.

Altcoins had a really tough weekend in the middle of the month. Source: tradingview.com

Smaller cryptocurrencies suffered truly excessive losses during the mid-month slump and then struggled to recover. In the worst 24-hour period, many altcoins fell by as much as 30 to 80%. For example, the meme token DOGE fell by more than 60% in a single day during the peak of the panic, and Avalanche (AVAX) fell by approximately 70% before finding a bottom.

Not all macroeconomic news in October was negative for cryptocurrencies. At the end of the month, the US Federal Reserve (Fed) provided some relief by cutting interest rates by 0.25 percentage points in an effort to mitigate the weakening labor market and sustain economic growth. This was the Fed's second consecutive rate cut in 2025, which was widely expected. Fed Chairman Jerome Powell warned that policymakers are divided on further easing and will proceed cautiously, especially as the concurrent government shutdown has left the Fed "flying blind" without new economic data. Nevertheless, the move signaled a more accommodative stance. Lower interest rates typically improve liquidity and risk appetite, which can be supportive for speculative assets such as cryptocurrencies. Indeed, the first signs of stabilization appeared in early November, with even stock and cryptocurrency markets rallying as investors digested the prospects for monetary easing.

A significant macroeconomic event that affected October was the shutdown of the US federal government, which began on October 1 and lasted 41 days—the longest in US history. This fiscal stalemate had two main impacts on cryptocurrency markets.

First, the prolonged closure of US federal agencies contributed to market uncertainty. It raised concerns about disruption to the US economy and delays in key government reports (employment, inflation) that markets monitor. Cryptocurrency prices mostly moved sideways in late October under the weight of this uncertainty.

Second, the shutdown caused regulatory paralysis. October was billed as a decisive month for several cryptocurrency ETF approvals, including applications for spot ETFs on Bitcoin and Ethereum and new funds for certain altcoins. However, once the government shut down, SEC decision-making froze—deadlines became meaningless because the agency was not functioning.

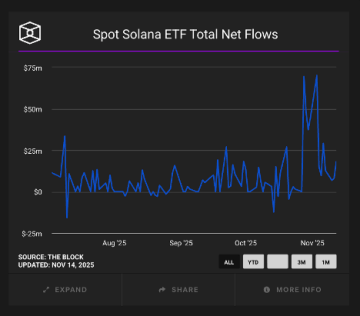

However, ETF issuers took matters into their own hands and took advantage of procedural nuances in securities law. At least four new cryptocurrency ETFs launched in the first week of November without explicit SEC approval by filing updated registration statements with "no-action" language. This tactic means that after a 20-day period, the filing automatically becomes effective unless the SEC proactively stops it. During the government shutdown, the SEC was unable to intervene, so fund managers took advantage of the opportunity. As a result, two funds from Canary Capital, one from Bitwise, and one from Grayscale were able to automatically begin trading on U.S. markets in the first days of November. These were primarily ETFs focused on altcoins (such as Solana and Litecoin trusts converted to ETFs and the upcoming XRP fund), rather than a major Bitcoin ETF — but they represent important first steps.

Bitwise's Solana ETF is experiencing nice inflows so far. Source: https://www.theblock.co/solana-etf-live-chart/340051/bitwise-solana-etf-bsol

Future market developments

Two significant events are influencing current developments in the cryptocurrency markets. The Fed's rate cut at the end of October is a potential turning point for future market sentiment. It marked the Fed's most accommodative stance in recent years, with rates falling to their lowest level in almost three years. If inflation remains under control, this could pave the way for further gradual rate cuts in 2026, providing a more favorable environment for liquidity.

The resolution of the US government shutdown (early November) removed a significant obstacle. Federal agencies, including the SEC and CFTC, are resuming normal operations. This means that stalled processes—notably the review of cryptocurrency ETFs and various regulatory guidelines—are returning to normal. We can expect a flurry of activity in mid- to late November. The SEC is likely to address the backlog of ETF registration applications. Thanks to the above factors, the prevailing mood in early November was cautiously optimistic.

The Fear and Greed Index, which hovered in the "fear" zone for most of October, began to rise as prices stabilized. In the first week of November, the index moved out of extreme fear, reflecting receding panic. Bitcoin's stabilization above $105,000 is restoring confidence. For investors, the general trend for major cryptocurrencies remains upward, albeit with typical large fluctuations.

With new macroeconomic factors (Fed rate cuts) and a potential game-changer in the form of ETF approval in the US on the horizon, the crypto market could be poised for a strong finish to the year. However, if the rate cuts are ultimately jeopardized, sentiment could quickly turn downward.

This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies are highly volatile and may be associated with the risk of capital loss. It is important to consult with an expert and conduct your own research before making any investment decisions. Probinex is not responsible for any losses that may arise as a result of investing in cryptocurrencies.