Earnio results for November 2025

2 months ago

Tomáš Hucík

The cryptocurrency market in November 2025 extended an extremely challenging period that had begun a month earlier. Following the October shock, Bitcoin made several attempts to stabilize, but the market was still recovering from a massive collapse in derivatives liquidity. Although short-term recovery attempts emerged, overall sentiment remained fragile, and volatility stayed well above its historical average.

From its October all-time high of approximately USD 124,000, Bitcoin declined to as low as USD 80,000 by mid-November, representing a 35% drawdown from the peak. Bitcoin’s monthly price decline in November reached −17.67%, with the asset closing the month around the USD 90,000 level, where it has remained to date.

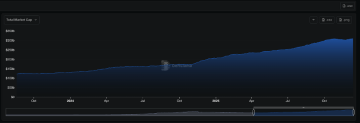

The total cryptocurrency market capitalization fell even more sharply, recording a −20% decline in November. The S&P Cryptocurrency Top 10 Equal Weight Index, which tracks the ten largest cryptocurrencies with equal weighting, experienced an even steeper −25% drop over the same period.

The Earnio Dynamic strategy delivered a −3.80% result for November 2025.

In the context of the broader market turmoil, this outcome can be considered controlled. It is clearly evident that the system was able to absorb elevated volatility and limit deeper drawdowns that materialized across the wider crypto ecosystem and among competing funds.

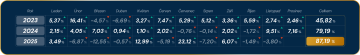

The overall performance of our trading activities over the past three years currently stands at just under 87%. November once again demonstrated that algorithmic trading cannot function effectively without rigorous risk management. Several competing systems failed during this period, as their algorithms were ill-prepared for sustained volatility and sudden liquidity contractions.

By contrast, our strategies performed reasonably well even under these adverse conditions, and the sharp declines observed across many altcoins were not reflected in our portfolio as severely as one might have expected.

Over the past three years, we have achieved total performance of just under 87%. Earnio Dynamic has an average annual compounded growth rate of over 30%.

A client who had the most favorable conditions from the very beginning of Earnio would thus have achieved an average annual compounded return of up to 16.59%.

Our Trading Activity

During November, our algorithms executed a total of 210 trades, of which 74 were profitable and 136 were losing, resulting in a win rate of 35.24%.

The average trade duration was 3 days and 17 hours.

The average profit per trade was USD 3,036.13, while the average loss amounted to −USD 1,970.22.

As always, I would like to remind everyone that the goal is not to “win” every single month, but to deliver long-term consistent performance.

Even several months with negative results can be perfectly acceptable from the perspective of the overall strategy—especially when they occur during one of the most challenging market periods of the entire year.

The most successful trade of the month took place on the BNB/USDT pair, where the strategy closed a profit of USD 27,347.03.

Conversely, the largest loss occurred on DOT/USDT, where a trade opened on November 8 at USD 3.3713 closed on November 13 at USD 2.8083, resulting in a loss of −USD 14,028.29.

Source: tradingview.com

The short upward move was exhausted (in line with overall market sentiment), and since then Polkadot has mostly declined and is now consolidating around the USD 2 level.

The most convincing performance came from our GGS strategy, which generated a profit of USD 13,000 across 40 positions. GGS is essentially the “rotational machine gun” of our portfolio. It is our most active symmetrical strategy (meaning it can trade both upward and downward moves), focusing on short, high-probability trend-following movements.

It features very flexible trade management: the largest portion of each position targets high-probability gains, while the remainder consists of “runners” that adapt to market structure. The strategy itself is composed of several time-based variations of the same core logic (trading across different time horizons).

Earnio Market Summary – November 2025

November kept crypto investors—including myself—on edge, as the euphoria from Bitcoin’s earlier rally faded and was replaced by a noticeably stronger correction. After reaching a historical high above USD 126,000 in early October, Bitcoin experienced one of its worst months in recent years during November.

Unlike previous sell-offs triggered by isolated events, this decline was driven by a convergence of several catalysts—from spot market selling and record ETF outflows to a decline in stablecoins and aggressive deleveraging in derivatives markets.

In short, November 2025 can be characterized as a month when fear returned to the cryptocurrency markets. Despite the turbulence, it is important to note that this drop—although sharp—was not a collapse of crypto infrastructure like in 2022. Major exchanges and lending platforms remained stable (there was no FTX-like failure), and leading stablecoins maintained their dollar peg despite heightened volatility.

What we witnessed was more of a controlled deleveraging process rather than a collapse—a cooling-off period following excessive optimism at the start of the year. Institutional and retail investors alike were simply forced to reassess their positions. While Donald Trump is a pro-crypto president, even that does not necessarily mean cryptocurrencies will rise nonstop in the face of broader macroeconomic conditions.

Technical Analysis

Source: Tradingview.com

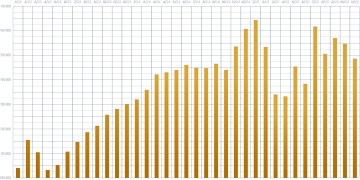

Bitcoin’s price action in November was clearly bearish, with several technical warning signals appearing throughout the month. After failing to hold the psychologically important USD 100,000 level early in the month, BTC entered a series of sharp sell-offs.

The decline culminated on November 21, when Bitcoin briefly dropped to a seven-month low around USD 80,000 within a single day. This move erased the remaining gains Bitcoin had accumulated in 2025—representing a dramatic reversal from the October peak of USD 126,000 back to price levels seen at the start of the year.

Momentum indicators on the charts definitively turned negative. By the end of November, BTC was consolidating around USD 90,000 in a fragile, stagnating trend, unable to re-establish its previous upward trajectory.

Exchange Flows

Source: cryptoquant.com

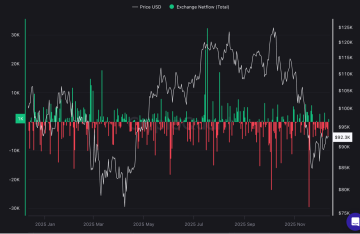

On-chain data from November reveals an interesting relationship between short-term traders and long-term holders. In the early phase of the sell-off, many short-term participants moved coins onto exchanges to reduce losses or risk, contributing to increased selling pressure.

However, as prices began to fall more freely, the situation reversed: Bitcoin started flowing off exchanges, signaling potential accumulation by more patient investors. This “exchange exodus” is typically a bullish signal. That said, the chart shows that days dominated by exchange inflows have not yet fully disappeared.

ETFs

Source: coinglass.com

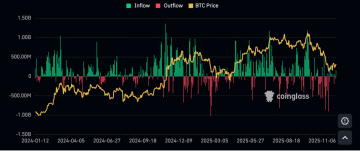

Exchange-traded funds (ETFs) became a double-edged sword for cryptocurrencies in 2025, a dynamic that played out dramatically in November. At the beginning of the year, capital inflows into spot Bitcoin ETFs were widely welcomed. In November, however, the same mechanism amplified the downturn.

Funds that had previously absorbed supply began selling BTC to meet redemptions, contributing further to market declines. Importantly, the crypto ETF universe has expanded beyond Bitcoin. ETFs based on Ethereum—and even Solana or XRP—have launched, with more expected to follow.

Stablecoin Activity

Source: defillama.com/stablecoins

For the first time in more than two years, the total market capitalization of stablecoins experienced a meaningful decline. While the 1.5% drop may not appear dramatic, its very occurrence is significant.

November marked the end of a multi-month expansionary trend, suggesting that some investors withdrew cash from the crypto ecosystem during the turbulence. Despite these outflows, stablecoins remained critical and largely stable throughout the chaos. Crucially, major stablecoins maintained their value even at the peak of the sell-off.

Fear & Greed Index

Source: alternative.me

In mid-November, sentiment in the crypto market reached its lowest point in recent memory. The widely followed Crypto Fear & Greed Index—which aggregates indicators of market emotion—shifted within a few weeks from “greed” in October to “extreme fear.”

At the beginning of October, the index stood around 74 (indicating moderate greed), but as prices fell, it dropped to just 10–11 between November 15 and 18. Such a sudden and deep shift indicates that traders were extremely nervous and pessimistic, with many expecting further losses.

The index remained at very low levels for several days as the downturn continued—demonstrating that fear itself can become fertile ground for additional declines.

This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies are highly volatile and may be associated with the risk of capital loss. It is important to consult with an expert and conduct your own research before making any investment decisions. Probinex is not responsible for any losses that may arise as a result of investing in cryptocurrencies.