Earnio results for August 2025

5 months ago

Tomáš Hucík

In August 2025, the crypto market delivered both excitement and challenges. Bitcoin hit a new all-time high above $124,000 on August 14 but then entered a choppy consolidation phase, ending the month around the low $110K’s, roughly -7% for August.

The total cryptocurrency market cap hovered near July’s peak, closing only slightly down at approximately $3.87 trillion, about -1.8% month-on-month.

The Bitwise 10 Large Cap Crypto Index finished August roughly -0.5%. In other words, August was the first time in many months that altcoins broadly outperformed Bitcoin.

Comparison with Benchmarks and Other Assets

In this market environment, we proceeded exactly as I outlined in previous articles, maintaining a bullish tilt with our portfolio. We are still somewhat more oriented towards long positions and our algorithmic trading strategies spread across roughly 20 cryptocurrencies.

Throughout August 2025, our automated algorithmic trading strategies executed 327 trades in total. Consistent with our trading philosophy, we did not focus on chasing a high win rate – and in fact our success rate this month was 36.1%, 118 winners vs. 209 losers.

Ultimately, our result for August was -7.20%.

If you follow my articles regularly, you know I warned that after July’s euphoria and our great result of 23%, a phase of consolidation or correction is not excluded. Unfortunately, that consolidation turned out deeper than we hoped, and it translated into a tough month for our strategy.

Despite the disappointing monthly loss, there are important silver linings in how we manage risk. With such a low win rate, one might expect an even worse outcome, possibly a far larger double-digit decline. That did not happen, and the reason is the beauty of disciplined algorithmic trading: our profitable trades, while fewer, were individually as large as our typical losses, and no single trade was allowed to wreak havoc on the portfolio.

In August, the average profit per winning trade was about $1,776, almost identical to the average loss per trade of -$1,769. This roughly 1:1 profit/loss ratio versus July’s 2.5:1 meant that with a 36% win rate the losses outweighed gains but it also means our loss-control rules did their job. Even in a month when our edge didn’t play out, every losing trade was kept small and contained. Negative results are always controlled and managed, never left to run unchecked. In terms of risk per position, we adhere to a protocol of limiting each trade’s potential loss, with max risk per one trade capped at 1% of the capital.

Our top trade in August was a long position on Ethereum (ETH) closed by our MIB strategy. Ethereum, the second-largest crypto, benefited greatly from the month’s altcoin rotation and institutional inflows. The MIB algorithm, which monitors momentum and price breakouts, identified ETH’s upward trajectory early in the month and entered a long position. This single trade captured about a 25% price move in ETH and $11.9k in profit. The strategy effectively capitalized on Ethereum’s mid-August rally, when Ether hit its highest levels in history.

Ether experienced parabolic growth in the first half of the month, followed by a series of sharp declines in which ETH surrendered some of its gains. However, interest from institutions and emerging companies focused solely on buying and accumulating ETH remains strong.

Our worst trade was on the DOTUSDT pair. In essence, GGS tried to ride a trend that failed to follow through, as the altcoin market faced a rapid pullback in those days. This outcome underscores a reality of trading: even a sound strategy will have losing trades when market conditions shift abruptly. The important part is that the loss was cut quickly in accordance with our system’s rules. No single trade, not even the worst one, violated our risk limits.

The most important thing is to monitor long-term indicators and not succumb to unnecessary emotions. Despite a negative month, Earnio Dynamic has an average annual trading result of 32%. A client with the most favorable client conditions would thus achieve an average return of up to 18.75% per year, with the largest decline in more than two and a half years being only 20%.

It’s worth noting that August 2025 was a volatile month market-wide, not just for us. A dramatic example came late in the month: a crypto whale transferred 24,000 BTC ≈$2.7 billion to an exchange, triggering a wave of liquidations. This flash event sent Bitcoin plunging about 6–10% within days from ~$113K to ~$108K and hit many altcoins hard. Our strategies weathered this shock reasonably well – thanks to protective stops, we avoided any single huge loss during the dip. Still, the rapid whipsaw in prices meant many of our positions were stopped out for small losses before the market found its footing again. This was a key factor behind the high number of losing trades, 209 this month. In other words, our system did exactly what it’s designed to do in a sudden downturn: cut losers fast and prevent any uncontrolled spirals. It’s the classic trade-off in risk management – we’ll gladly accept a month of modest losses over risking a catastrophic loss. As I’ve emphasized before, the goal of algorithmic trading is not to win every single month, but to achieve strong performance over the long run.

Crypto Market Overview – August 2025

After July’s spectacular rally, August 2025 brought a mix of new highs and rapid corrections. Early in the month, bullish momentum carried the market to fresh records. Bitcoin (BTC) opened August around $115K and surged to a new all-time high of ~$124,000 by mid-month. This breakout above the psychological $120K level on August 14 was fueled by ongoing optimism and institutional demand. However, BTC could not hold those highs. Following the peak, Bitcoin retraced and spent the latter half of August oscillating between roughly $104,000 and $114,000. By month’s end, it stabilized near ~$108–110K – about a 7–8% pullback from July’s close. This range around $104K–$114K reflected a post-euphoria consolidation phase after the big run-up, with high volatility but unclear direction. In essence, Bitcoin gave back a portion of its gains, which is not unusual after four consecutive bullish months.

Ethereum (ETH), on the other hand, continued to shine in August. Building on its July strength, Ether climbed decisively above $4,000 and on August 24 reached a new all-time high of ~$4,948. This marked Ethereum’s first time in price discovery since late 2021, a significant milestone. Following that peak, ETH did see profit-taking – it dipped back to around $4,400 in the final days of the month.

The altcoin rally was very uneven. Investors were selective, pouring money into high-conviction projects and those with bullish catalysts, while shunning others. By month-end, many weaker or more speculative alts actually ended in the red, even as the stronger ones held gains. Ripple, which had spiked in July, retraced about 7% in August, and Dogecoin slid roughly -9% after its mid-month hype. HYPE on the other hand booked nice gains. It seems that we are finally getting to the phase of the market when participants start to value real growth, cash flow and revenue.

Key Macroeconomic Developments

Early August optimism was tempered by U.S. inflation numbers: on August 10, the July Consumer Price Index (CPI) report came out, showing headline inflation at 2.7% year-over-year. While these figures indicated that inflation is far below 2022 highs, the rate of disinflation was slower than hoped. After Bitcoin hit $124K around August 14, that CPI data contributed to a cooling off; one could say it set a ceiling on crypto’s mid-month exuberance.

The next major macro event was Fed Chair Jerome Powell’s speech at Jackson Hole on August 22. Leading into it, markets were on edge for any hint of policy change. In the end, Powell reinforced a cautious, data-dependent stance, neither strongly hawkish nor dovish. He acknowledged that inflation was coming down but remained above target, and he did not commit to any specific timeline for interest rate cuts. In the big picture, the Jackson Hole message supported the idea that the Fed will likely hold rates steady and potentially cut in coming months, which should be bullish for crypto, but any actual easing will depend on continued improvement in inflation metrics.

The SEC issued guidance in early August clarifying that liquid staking tokens like Lido’s stETH or Solana’s Jito token are not to be treated as securities. This was a big win for the DeFi community. Liquid staking tokens, which represent staked crypto but remain tradable, are crucial for yield farming and liquidity in DeFi. By confirming these tokens aren’t securities, regulators removed a huge compliance burden and basically green-lit institutional investors to participate in this corner of the market. This news arguably contributed to the strong performance of staking service tokens, as well as Ethereum’s rally, since ETH is the largest staked asset.

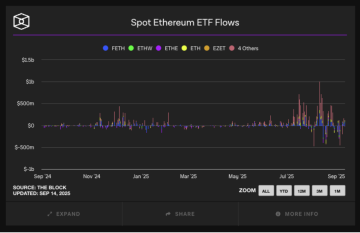

ETF and Institutional Capital Inflows

One of the most encouraging themes of 2025, and of August in particular, has been the surge of institutional capital into cryptocurrency investment products. This trend not only continued in August – it hit new records, especially for Ethereum-focused funds. Such inflows are a strong tailwind for the market, often providing price support during dips and signaling growing mainstream acceptance. Ethereum attracted the lion’s share of new institutional money. According to fund flow data, U.S. spot Ether ETFs saw about $3.87 billion in net inflows in August, the highest ever, while Bitcoin ETFs had a net outflow of roughly $751 million. In other words, institutions were rotating into ETH – likely viewing it as undervalued relative to BTC, which had already run up a lot by mid-year, and as a beneficiary of the growing DeFi and stablecoin trend.

All these developments highlight a key point: the continuous inflow of capital from large players is reaching new heights, and it’s fundamentally bullish. When you have billions of dollars flowing into BTC and ETH funds, it creates an underlying demand that wasn’t present in past cycles. It also means that an increasing slice of the crypto supply is being held in long-term investment structures such as ETFs, trusts, custodial accounts rather than by short-term speculators. For example, by the end of August, U.S. funds alone held around 4.8% of Ethereum’s total market cap in their reserves – a remarkable figure that shows institutional adoption in action.

Fear and Greed Index and Market Sentiment

Investor sentiment in the crypto market went on a rollercoaster ride in August – from greedy euphoria at mid-month to wary caution by the end. The Crypto Fear & Greed Index, which aggregates market sentiment metrics, encapsulated this shift nicely. In early August, sentiment was still riding high from July’s rally: the index started the month in the Greed zone, around the low 60s. As Bitcoin and Ethereum pushed to new highs, optimism peaked. By roughly the second week, around August 14 when BTC broke $124K, anecdotal signs of euphoria were emerging: crypto Twitter was buzzing with moon predictions, Google searches for “Bitcoin” hit multi-month highs, and even casual conversations suggested FOMO was creeping back in. The Fear and Greed Index likely climbed further into Extreme Greed territory in the 70s or even higher at that point.

However, as mentioned, the mood changed abruptly mid-month. The combination of the whale-induced flash crash and broader market pullback injected fear back into the equation. Within days, the Greed index plummeted from exuberant levels down toward neutral. By the final week of August, it actually dipped into the Neutral or even low Fear range, registering around 40–50. This swing from Greed to Neutral/Fear indicated that traders had become much more cautious. Liquidations north of $800–900M during the volatility spike certainly rattled many short-term participants, as covered in Aurpay’s weekly analysis.

This sentiment whipsaw is typical in crypto bull markets: periods of extreme greed often precede short-term tops, and subsequent pullbacks restore a bit of fear which can set the stage for the next leg up

Outlook for September 2025

From our perspective, the overarching bull trend remains intact. After the August pullback, it would not be surprising to see Bitcoin trade in a range or even retest lower support levels in early September. Key levels we’re watching: on the downside, the $100,000 mark stands as a major psychological and technical support, a level which held firm during the July rally and August dip. Before that, the $112,000 zone, roughly where BTC found support in August, is important – a sustained break below $112K could open up a deeper correction towards $100K. On the upside, $125,000 is the immediate ceiling to beat; if BTC can decisively clear $125K, its August high vicinity, it would likely trigger a fresh wave of buying, a breakout rally, and target the next region around $130–140K. Our base case for September is that Bitcoin will mostly range between $110K and $125K, barring any major catalyst. This would actually be healthy – digesting the prior gains and forming a springboard for Q4.

Macroeconomic conditions for September appear cautiously favorable. Global liquidity continues to be abundant – central banks, while not cutting aggressively yet, have broadly paused tightening. The market is pricing in a high probability of a Fed rate cut by the end of this month’s FOMC meeting, especially after recent data showed cooling inflation and some labor market softening.

For altcoins, September will be telling. If Bitcoin remains stable or only slowly climbs, it could allow another round of altcoin outperformance – essentially a continuation of the altseason narrative. We would expect Ethereum to be a primary beneficiary, as it often is when alts surge. In addition, given August’s lessons, we anticipate capital will concentrate in high-quality alt projects: layer-1s like Solana, utility tokens like Chainlink, exchange tokens and others, rather than indiscriminately lifting every coin. Some beaten-down altcoins might see relief rallies, especially if they have positive news or development milestones in September, but others with cooling hype may languish. Unless the market turns extremely euphoric again, September won’t be kind to many low-liquidity meme coins; traders seem to have grown more cautious after a few blow-ups. Our strategy will thus continue to favor altcoins with real momentum and volume and avoid chasing fads that lack substance.