Earnio Market News: The crypto market in high volatility and key signals

3 months ago

Tomáš Hucík

The cryptocurrency market has entered a period of increased volatility. Although long-term fundamentals remain stable, short-term conditions have worsened and sentiment is shifting toward caution. Below, you will find an overview of the key events that were moving the needle during the period of 12 to 26 November 2025.

Bitcoin below 90,000 USD: a correction after overheated growth

Source: tradingview.com

Main reasons for the decline:

Weak structure of the previous growth

The price increase was largely driven by short-term capital inflows, rapid speculation, and inflows into spot ETFs. This means the growth was not “organic”—it wasn’t driven by long-term demand but rather by a one-off impulse.Macroeconomic tightening

Ongoing tightening of dollar liquidity and increased risk aversion have worsened conditions for all risk assets. Cryptocurrencies tend to be sensitive to such changes.Weakening investment sentiment

A combination of high volatility, technical signals (e.g., the crossing of key moving averages), and cooling demand is creating, in theory, room for a deeper correction toward 80,000 USD.

At the moment, Bitcoin is consolidating around 90,000 USD and is deciding which direction it will take next.

Spot ETFs in the red: pressure on retail and an emerging selling spiral

Most investors who entered spot Bitcoin ETFs during the peak phase of the rally are currently at a loss. This has two consequences.

Retail investors are losing patience

At the first signs of more significant losses, retail investors typically react with panic selling. This increases downward pressure on the price and can further amplify volatility.Decreasing willingness to attract new capital

New investors usually enter during growth periods, not during corrections. In the short term, this means ETFs stop being a driver of growth and may instead become a drag on it.

source: https://www.theblock.co/data/etfs/bitcoin-etf/spot-bitcoin-etf-flows

Spot ETFs, which were until recently considered a stabilizing element, are currently acting more like an amplifier of market sentiment. However, it should be noted that even so, ETF investors are likely in this investment for a longer period than a typical retail investor with a trading app on their phone.

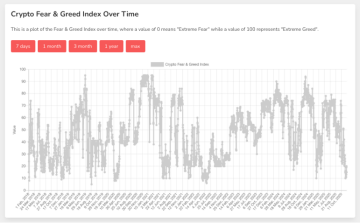

Fear & Greed Index: extreme fear doesn’t necessarily mean an immediate opportunity

Market sentiment has shifted into the zone of extreme fear. This is usually interpreted as a signal of a potential bottom, but historical experience shows that:

the market can remain in this zone for an extended period,

prices can continue to fall despite a “promising-looking” sentiment reading,

extreme fear is typically associated with periods of capital reshuffling.

The Czech National Bank is building a test crypto portfolio: a small experiment with strong symbolism

The Czech National Bank has announced the creation of a test cryptocurrency portfolio, which includes primarily Bitcoin and stablecoins.

The purpose of the project:

To practically test methods of holding and managing digital assets.

To acquire internal know-how regarding security and operational processes.

To prepare the institution for possible future scenarios in which digital assets play a more significant role in the economy.

Although the amount is small and not intended for returns, it represents an important signal of progress: even conservative institutions are beginning to view crypto as a relevant technological area that must be understood rather than ignored.

Prediction markets: rapid industry growth and the first systemic warnings

Platforms like Kalshi and Polymarket are experiencing a significant inflow of capital and users.

Kalshi is receiving new funding (reportedly up to 1 billion dollars) and strengthening its position in the market.

Polymarket has received renewed approval from the U.S. regulator CFTC, which allows it to return to the domestic U.S. market.

At the same time, however, some institutions are pointing out emerging risks — particularly credit exposures, rising debt, and delayed regulation in a rapidly growing sector that some describe as advanced finance and others as outright gambling.

Impact on the markets:

Prediction markets are becoming a new class of digital assets attracting capital not only from crypto but also from sports betting and traditional derivatives. It is a trend that may significantly influence how investors work with information and uncertainty in the coming years.

The final takes from this article

Short-term sentiment is negative, but the market is still behaving within an expected cycle.

Bitcoin is undergoing a correction after an overly rapid rise, which is not unusual during periods of reduced liquidity.

ETF investors will play a role in determining the pace of further developments, as their behavior significantly influences capital flows.

The institutional world is opening up to crypto, albeit very cautiously — the Czech National Bank is one example.

Prediction markets are growing and may become a relevant topic for investors seeking diversification beyond traditional assets.

This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies are highly volatile and may involve the risk of capital loss. Before making any investment decision, it is important to consult a professional and conduct your own research. Probinex bears no responsibility for any losses that may arise as a result of investments in cryptocurrencies.