Earnio results for July 2024

8 months ago

Tomáš Hucík

In every Earnio results article, I try to focus on bitcoin's price performance on the chart at the beginning. And if you've read my Earnio blog article last month, you know that this price chart is giving us mixed signals so far.

It may seem that the bitcoin chart is currently depicting a so-called crab market, i.e. that it is just moving sideways within a channel bounded on the top by a price level of about $70,000 per BTC and on the bottom by about $50,000 per BTC. But this channel, which is otherwise quite large, has one characteristic feature that can be observed more and more on the chart as time goes on.

Source: tradingview. The chart shows how bitcoin is not able to drive the price higher, but it can fall down. The arrows indicate recent important events.

The chart depicts lower lows, but also lower highs. This means that these low levels are gradually getting lower and lower, but the higher levels are also gradually dropping to lower levels. It's already relatively easy to see that bitcoin has been in a slightly downward channel for a few months after all. It's not very significant, but it is observable.

In addition, there are quite significant short-term movements within this channel. Market participants seem to be very sensitive to any signals. Any negative news will first cause sell-offs and then, when the market calms down after a few hours and traders realize that even this news does not mark the end of the world and crypto in general, there is a gradual buy-back of the decline. But it also works the other way around. Any positive news triggers manic buying, and after a few hours, traders realize that even this doesn't mean that bread will be cheaper, or that bitcoin will suddenly replace gold, and so the shorts (market participants who sell) step in and push the price back down again.

Cryptocurrencies have always been very volatile. But it seems to me that currently traders' sensitivity to any news is even more heightened. This is perhaps related to some uncertainty and unease that is prevailing in the market. On the one hand, we have positive news from the crypto world like the Bitcoin ETF and the Ethereum ETF, pronounced pro-crypto US presidential candidate, or when US banks allowed their advisors to offer cryptocurrency investments.

On the other hand, we have the macroeconomic situation in the world. The soft landing of the US economy may not be so soft after all, Japan's economy is even worse off, several wars are raging in the world, and a few more may break out soon.

In the first half of July, the market struggled to cope with the bad mood on the market, which was mainly caused by the sales of the German authorities. According to German regulations, all items seized in criminal proceedings have to be sold, and so Germany forced the sale of about 50k btc into the market. The mood in the market at the beginning of the month was not aided by the announced distribution of assets stolen from clients in a hacking attack in 2014 from the Mt. Gox exchange, as bitcoins that were not there before are flooding the market.

But the situation has reversed and the market went up after the failed assassination attempt on Donald Trump and this is because Donald Trump presents himself as a pro-crypto candidate and has survived the assassination attempt.

In addition, just days after the assassination, Donald Trump attended the annual bitcoin conference in Nashville. In his speech to the audience at the conference, he managed to promise a lot. But all of these were positive promises for the crypto-industry.

But over time, the euphoria caused by Trump faded, and by the end of July, the price of bitcoin began to gradually fall.

This decline was further accelerated by a mix of bad macroeconomic news from the world in the first week of August.

Whether it was the economic results from the U.S., or the problems in the Japanese market, it pushed the price of bitcoin below $50,000.

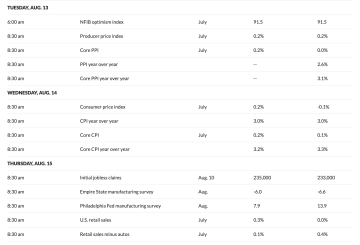

The Fear and greed index (which measures how greedy traders are vs. how fearful they are) even reached a relative value of 17, the lowest since July 2022.

The Fear and greed index has been very volatile lately. It can rise significantly in a matter of a few days, but it can also fall. Source: https://alternative.me/crypto/fear-and-greed-index/

If you want to learn more about what caused the recent plunge in global markets, you can listen to our podcast with Adam on the subject.

How did our portfolio react to the global situation?

At Earnio, we make no secret of the fact that the algorithmic strategies we currently have in place are more pro-growth oriented, and therefore more suited to a rising market. However, as the market is slightly down, these strategies are thus not reaching their full potential, and have generated a small loss in July.

This loss was partially covered by the non-vector part of our portfolio, i.e. the part that is not so dependent on market direction. This includes, for example, market making or arbitrage.

In July, we also tried accumulating cryptocurrencies into a spot portfolio in Earnio for the first time. Since Earnio is also intended to serve as a liquidity layer for our exchange and stock exchange, we will gradually try to accumulate cryptocurrencies at low price levels, which can then be used for operations within the aforementioned products.

The cryptocurrency we accumulated this time was ether. However, because a few days later in early August the market experienced the aforementioned drop (which more or less nobody in the market expected, who knew that this was the date when Japan would decide to raise interest rates) we were forced to work very carefully with the position. Gradually, as the price of ether fell, we purchased more so that our average purchase price decreased. Then when the market regained strength, we sold the entire position at a nice profit.

This is where careful portfolio work and years of experience showed wonderfully; many inexperienced managers would have frantically sold in a downturn, for example.

We are currently monitoring the current macroeconomic developments very closely.

In the week from 12th August to 16th August, we are expecting an influx of several economic data from America, which can give us a clue about the direction of the market.

The Initial report on the employment situation will be the one to watch on Thursday Source: U.S. Economic Calendar – MarketWatch

Since we do not consider the thesis that we are still in a bull market (a rising market, the opposite of a bear market) to be invalidated yet, pro-growth algorithmic strategies remain deployed for the time being. However, we are working on changing and more careful selection of cryptocurrencies they trade.

Should the bull market thesis be invalidated, we too are prepared to rebuild the portfolio.

Earnio reports a loss for the first time in 15 months. This is also evidence of a well-composed portfolio. Negative months are a part of trading, it is important to be consistent and not get hung up on the natural variation, especially in a minor way.

Earnio's result for the month of July is -0.76%.

Earnio results for March 2025

March 2025 brought a volatile mix to the crypto market. Bitcoin stayed in a range, altcoins suffered, and Donald Trump influenced global markets with new tariffs and the creation of a U.S. Bitcoin Reserve. In such conditions, risk management and a long-term view became essential for investors and trading strategies.

Earnio results for February 2025

A recap of February's crypto market: why Bitcoin dropped 25 %, what triggered the sell-offs, and how our Earnio Dynamic strategies managed this challenging month.