Earnio Market News: precious metals run, crypto stagnates, and key market trends

3 weeks ago

Tomáš Hucík

The past two weeks brought clear divergences: traditional safe havens are smashing records, but bitcoin is lacking.

Below is a quick overview of the most relevant developments shaping market narratives recently.

Market overview: metals hit all-time highs, crypto mixed

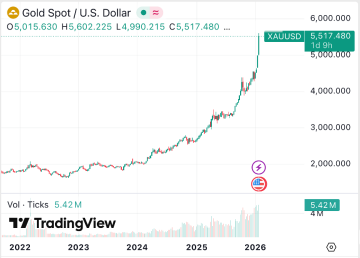

Gold and silver have been on a historic run. Spot gold surpassed its previous all-time highs in late January 2026, breaking above $5,000 per ounce as investors sought safety amid macro uncertainty.

Silver has also reached lifetime highs, with prices climbing sharply and breaking key previous records on major exchanges.

In contrast, broader crypto hasn’t printed fresh all-time highs as an asset class. Bitcoin and most major tokens are trading below their peak levels from prior cycles, even as some narratives attempt to rekindle bullish sentiment.

The exception inside crypto was Monero (XMR) — the privacy-focused altcoin recently made a new all-time high near its previous peak in January 2026 , showing notable upside amid broader market consolidation.

Safe-haven assets continue to demand attention even as crypto narratives seek fresh catalysts.

Buyback optimism: headlines vs. reality

A growing number of projects including Pendle, Aster, or Aave and others have publicly announced token buyback programs in recent weeks, positioning them as mechanisms to reduce supply and support price. Protocol buybacks are often highlighted as a sign of real revenue and token-backed value creation.

However, CoinGecko’s recent survey of buybacks across 28 projects shows that buybacks alone do not guarantee price support in the short term. Many tokens with active buyback programs have still seen declines as broader supply and demand dynamics continued to weigh on prices.

Buybacks are a tool, not a short-cut: they matter most when revenue is durable and supply pressures are limited.

Hyperliquid rallies: strong narrative meets sceptical debate

One standout in crypto price action recently has been Hyperliquid which has shown strong momentum and outperformance relative to many altcoins.

Supporters argue its fee-driven revenue capture and active fee return mechanics provide a robust fundamental undercurrent, while detractors on social platforms and X point to decentralization trade-offs and the risk that narrative-driven flows could reverse. These recurring debates reflect the typical tug-of-war between “cashflow token” narratives and structural risk concerns.

Hyperliquid’s recent gains reflect selective risk appetite, but debate remains over durability and market structure.

Quantum FUD and bitcoin resilience

In the last two weeks, commentary around quantum computing risk for Bitcoin resurfaced, partly driven by broader macro uncertainty and BTC’s lack of fresh highs compared to safe-haven assets.

This narrative triggered renewed FUD (Fear, Uncertainty, Doubt) in some corners, with questions about whether Bitcoin’s cryptography is future-proof.

At the same time, influential voices in the space pushed back, emphasizing that preparation and research, not panic, should define the response, and highlighting that proposals for post-quantum signature schemes are under discussion within developer communities.

Institucional signals: Ledger, Certik and Bitgo movig towards public markets

One notable theme beyond price charts is the movement of crypto infrastructure into public markets.

BitGo has already completed its IPO, gaining public equity exposure and signaling institutional demand for regulated crypto infrastructure.

Ledger is reportedly exploring a U.S. listing at a multibillion valuation, highlighting investor appetite for wallet and custody services.

CertiK has publicly stated its intention to pursue an IPO, reinforcing the trend of security-focused firms entering traditional capital markets

These developments suggest maturation of crypto infrastructure and investor confidence in long-term revenue generation beyond pure token speculation.

Summary

In the last fortnight we’ve seen precious metals set new records, crypto narratives both heat up and fragment, and institutional capitalization themes come into focus.

Gold and silver continue to draw risk-off interest, while crypto still grapples with selective strengths and broader participation challenges. As always, context matters more than headlines in assessing where real value and conviction are building.

This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies are highly volatile and may involve a risk of capital loss. Before making any investment decision, it is important to consult a professional and conduct your own research. Probinex assumes no responsibility for any losses that may arise as a result of investments in cryptocurrencies.