Earnio Market News: 2026 starts in risk-on mode as major coins rise and meme coins wake up

1 month ago

Tomáš Hucík

The first week of 2026 brought a clear shift in sentiment. After the holidays, liquidity is back, major coins are moving again, and the market looks ready to continue the trend.

Below is a quick overview of the key themes shaping the start of the year.

Market overview:

BTC back around 92k, ETH steady above $3.2k

Bitcoin broke above $90,000 — the key question now is whether it can hold that level. Source: TradingView.com.

Early-year price action is doing exactly what many hoped for: it resets sentiment, pulls capital back in, and tests important levels.

Bitcoin (BTC): briefly hit an intraday high of $94,346 and is currently trading around $92,000.

Ethereum (ETH): currently around $3,200, comfortably above the psychological $3,000 level.

Risk appetite is back: meme coins started the year with a strong rally — PEPE peaked at roughly +75%.

Meme coins are also seeing speculative inflows at the start of the year. Source: TradingView.com.

The altcoin race begins: Bitwise files for a new wave of crypto ETFs

After a year driven mostly by “BTC (and maybe ETH),” the product pipeline is now genuinely expanding into altcoins as well.

Bitwise filed with the U.S. SEC for 11 crypto ETFs — covering AAVE, CC, ENA, Hyperliquid (HYPE), NEAR, STRK, SUI, TAO, TRX, UNI, and ZEC.

In a broader context, one of the big themes at the start of 2026 is building a “traditional financial wrapper” around crypto to make it much easier to invest. No wallets or on-chain transactions are needed — investors can simply go through their broker or bank.

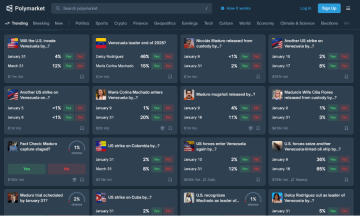

Prediction markets: Maduro captured — Polymarket “called it”

One of the week’s most surreal combinations was politics meeting on-chain prediction markets.

Reports said Venezuelan leader Nicolás Maduro was captured during a U.S. military operation and later faced charges in the U.S.

At the same time, attention focused on a newly created Polymarket account that, shortly before the event, bet aggressively on Maduro being removed from power by the end of January — turning roughly $30,000 into about $400,000.

Polymarket has long faced criticism for being an essentially unregulated breeding ground for insider trading and other questionable activity.

Polymarket can be a playground if you understand global politics — or if you have “inside” information. Source: Polymarket.com.

Funds: Strategy remains in major indexes — for now

One of the most watched “crypto proxy” stocks remains Strategy (formerly MicroStrategy). A key question was whether index providers would start treating companies with massive bitcoin treasuries as quasi-funds and exclude them.

MSCI postponed plans to exclude companies holding treasuries in digital assets (DATs) and instead launched a broader review — meaning companies like Strategy remain in benchmark indexes for now.

This matters because index inclusion can mechanically attract passive capital. When investors buy an index, they also buy indirect exposure to crypto through these companies. Maintaining the status quo reduces short-term risk of forced selling — even if this topic is likely to return later.

Security reminder for 2026: safety first

At the start of the year, it’s worth revisiting the most basic security principles:

Use a hardware wallet for long-term holding.

If you have larger crypto holdings, consider using a separate device for crypto activities.

Enable 2FA everywhere possible.

Never store your seed phrase in notes, screenshots, or the cloud.

Check links, domains, and wallet approvals — once you sign, it’s final.

Conclusion

The first days of 2026 brought a familiar mix: major coins are rising, institutions are rolling out new products, and geopolitics is intersecting with crypto infrastructure. The direction is positive, but volatility comes with it — so caution remains important.

This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies are highly volatile and may involve a risk of capital loss. Before making any investment decision, it is important to consult a professional and conduct your own research. Probinex assumes no responsibility for any losses that may arise as a result of investments in cryptocurrencies.