Earnio results for October 2024

1 year ago

Tomáš Hucík

In my regular articles on Earnio, I usually start by discussing the market development over the past month and then describe how our trading strategies fared that month.

However, given the extremely interesting developments of the last few days, writing about the market situation in October feels to me like yesterday's newspaper that nobody wants to read.

The structure of this article will therefore be different. In the first part, I will deal directly with our October results, in the second part I will elaborate on what has happened in the last few days, and in the conclusion, I will outline what you can expect from us.

Our results

The market situation was quite uncertain in October. Cryptocurrencies seemed to be hanging in "limbo", waiting to see what the outcome of the US election would bring. Trading in such a market can be risky. If you read my articles regularly, then you know that we currently have the same bionic strategies deployed in both the Earnio and StayKing portoflio. So a trader manually enters the same orders in both Earnio and Probinex. And if you read carefully the last article on StayKing, you also know that we have not been very successful with manual trading.

If you want to read in more detail about our bionic strategy in October, I recommend the article on StayKing, I'm only picking out a portion of it:

"Volatile swings occurred at the exact moments when protective stop-loss orders intervened, and trades were successively closed at minor losses. Thus, six of these trades ended in losses and one in profits. We do not attach any particular significance to this; losses are a natural variation in trading strategy. Sometimes trades work out better, sometimes worse. What is important is the total sum in the long run. "

Automated algorithmic strategies did not fare well in October. I hate to repeat myself, but I think it's worth pointing out again that this is not something we didn't count on or that would have surprised us. In trading, negative months are normal, there is no other way, and if someone tells you they have been trading for years and have not experienced a negative month, they are lying. A negative result, or even multiple negative results in a row, is the natural cycle of trading. Longevity and the end result are important.

So Earnio posted a loss in October - 1.72%.

Market situation

The US presidential election was held in early November. Donald Trump won and the price of bitcoin and other cryptocurrencies rose sharply in response.

Did you expect Trump to win? Personally, I had pretty much counted on this possibility. As I waded through the stagnant waters of Excel and compared the data on mail-in ballot applications in each precinct in the key state of Pennsylvania with previous historical data, I wondered if I was overreacting. But the truth is that in trading, you must take advantage of every advantage the market offers.

Well, for example, from this data, it looked like Trump was likely to make it. Again, somewhat immodestly, I'll quote myself.

"The ratio of mail-in requests in 2000 was about 2.51 in favor of the Democrats ( 2.5 Democratic requests vs. 1 Republican request). Now it looks like the ratio of requests for mail-in ballots will be only about something like 1.7 to 1.8 in favor of Democrats ( 1.7 requests from Democrats vs. 1 request from Republicans)."

But Trump's victory turned out to be far more convincing than anyone expected.

And this win can be partially attributed to crypto fans. For all the cryptocurrency-related factors, I'll highlight at least three.

Polymarket

Polymarket is a prediction market, a native cryptocurrency platform that allows you to bet on the outcome of almost anything. What's more, before the decisive moment comes that will determine the winner, you have the opportunity to trade your prediction.

Polymarket was one of the winners of this election. Not only did the tipsters there correctly predict Trump's election, but Polymarket also got into the Bloomberg terminal as a resource. The Bloomberg terminal is an analytics tool used by financial institutions that aggregates a variety of economic data. Well now it also aggregates what people are betting on Polymarket.

But it's not all rosy. Polymarket has several, so far quite significant, flaws. One is that it doesn't actually show who people will vote for, but who people are betting on to win. That's a fundamental difference. Moreover, if you find that the odds on one of the candidates are bad, you can buy that vote and then, when the odds move in your favor, sell it again.

So basically, the Polymarket is just accurately portraying how people are currently speculating about who will win.

Moreover, even the speculators may not be right about everything. Donald Trump may have been guessed by the majority of tipsters, but who the majority of Americans will vote for, for example, has not been correctly guessed.

At Polymarket, it only takes a few extra millions of dollars to swing the odds of a prediction market for presidential election. And when it comes to the position of the President in the US, it's not such a big expense that it can't be taken as part of marketing and deliberately trying to influence public opinion in that direction. There are already known cases of whales who have managed to corner the market with a few million.

Apropos the sheer size of the market at Polymarket. After the election, there are indications that there may have been inflated volumes, deliberate over-reporting and the like.

Still, you can't deny Polymarket had a really big impact on this election, even Trump himself mentioned it, even though if he mangled the name a bit.

Fairshake

Fairshake, which is actually a political lobbying committee (a super PAC), has greatly influenced American elections, not only presidential but also congressional. In fact, Fairshake supports candidates who favor cryptocurrencies. The organization is funded by major cryptocurrency companies and investors such as Ripple Labs, Coinbase, and the Winklevoss brothers, and in total, Fairshake has raised more than $160 million.

Thus, during the election cycle, Fairshake has been actively involved in various political campaigns, supporting candidates who support the development of cryptocurrencies and speaking out against those who criticize the industry. Notable, for example, was the Pennsylvania Senate race, where Fairshake-backed pro-crypto candidate Bernie Moreno defeated longtime Senator Sherrod Brown.

So, it is now clear that tens of millions in cryptocurrency support cannot be seen just tossed out the window.

Voters base

The last point is a little harder to measure, but it makes logical sense. Donald Trump has positioned himself as a pro-crypto candidate. Well, cryptocurrency holders are often "single issue voters", which means they vote based on that one issue. But the Democrats have not been able to create a coherent platform on this issue and so they have lost these voters. Moreover, there are no "single issue" voters on the other side of the barricade who oppose cryptocurrencies and who stand to gain by doing so.

It is a signal to both sides that they have nothing to gain by fighting cryptocurrencies, quite the opposite.

Anyway, Donald Trump has now won the election. What can we expect?

One of the things Donal Trump has promised is the firing of the head of the US Securities and Exchange Commission, Gary Gensler. Gensler is strongly anti-cryptocurrency and with him, in fact, the entire commission. By firing him and changing the view on crypto, the US could become attractive again for many cryptocurrency projects.

The SEC leadership is really not popular among the crypto community, which is nicely summed up by this quote from Ben Horowitz, founder of the A16z fund.

🚨HOROWITZ: "The Biden regulators lied about Crypto and said "we have to protect consumers," but as they were terrorizing every compliant and legal company, they let all the crazy fly-by-night memecoins and scams run, because they wanted to destroy the industry and destroy trust… pic.twitter.com/TExk1UNSwl

— Autism Capital 🧩 (@AutismCapital) November 13, 2024

It could, for example, help open the door for projects to share revenue with their token holders. Until now, U.S. crypto projects have been afraid to do this because they feared accusations that their token was a security, or that the tokens they offered were a security. But now it seems the tables are beginning to turn. For example, two days after Donald Trump's election, the cryptocurrency project Ethena is already considering putting this sharing of its proceeds with ENA token holders to a vote. Other cryptocurrencies like UNI, AAVE or LIDO may follow as well.

Donald Trump has also talked about building a federal bitcoin reserve. This means that the US would accumulate bitcoins into national reserves, similar to gold. However, politically pushing this initiative will likely be more difficult than replacing the leadership of the SEC.

For starters, however, it will probably be enough if Donald Trump commits not to sell any of the thousands of bitcoins the US currently holds.

But the push to create a bitcoin federal reserve isn't just coming from Trump. It may be backed by Senator Cynthia Lummis, for example, who is beginning to reassert her proposal that the US begin creating this reserve within 5 years.

The downside of announcing this initiative is that other countries may try to front-run it. Well, that's what rumors are circulating on the internet right now.

And just to lighten things up:

One area that is outperforming even bitcoin itself is meme coins.

These function as a sort of fake crazy bitcoin, extreme risk, cryptocurrency on cocaine. The most famous cryptocurrency, DOGE, which by the way is also Elon Musk's favorite cryptocurrency, is currently the fifth largest cryptocurrency in the world. It has been appreciated by more than 100% since the election.

Source: tradingview.com

By the way, a new department is currently being created in the US to oversee efficient government. This ministry will be co-chaired by Elon Musk.

Do you know what the name of this ministry will be?

Department Of Government Efficiency.

Be warned, this paragraph is definitely not investment advice or an incentive.

Our portflio

The election of Donald Trump has had the impact on the markets that we expected. I dare say that the rise in prices may be even faster than the experts have estimated.

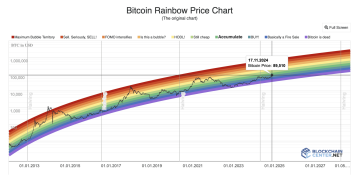

With Bitcoin reaching ever higher on the chart, it's hard to say where it may stop. But also, when it may start falling again. You can help yourself with various rainbow charts, but the truth is that they are all just estimates.

Source: blockchaincenter.not. When bitcoin is at the bottom of the chart, it's typically a good opportunity for investment. But you can see how the waves are gradually smoothing out.

We're currently considering increasing the sizing in our portfolio, taking a bit more "risk". So that would mean opening up bigger positions, for example. But for that to happen, two conditions must be met. Persistent positive market sentiment and at least a partial decline or calming. Increasing risk just when everything is pumping can backfire horribly.

However, we believe that if the positive market sentiment persists, the potential in Earnio is great. After all, we have been waiting for this market for the last six months.